Debt Consolidation: Exploring the Path to Financial Freedom

Discover the power of debt consolidation and take control of your financial future.

This article will cover the main decision-making criteria for first home buyers looking to get into a home, and how advice can help you get into a property sooner. And for existing homeowners or property investors, debt consolidation will lower your monthly expenditure to focus on repaying your current mortgage or purchase your next investment.

Debt consolidation allows you to combine debts like vehicle finance, credit cards and store cards, hire purchases and other personal loans – even your student loan, into one or sometimes two loans. If you are a homeowner already, this could be added to your existing home loan. The biggest reason to use a Financial Adviser* if you are considering debt consolidation is you will receive advice. Staff at the bank or finance company cannot show you how this decision will affect your overall financial situation, including the best way to get out of debt.

Main Reasons to Consider Debt Consolidation:

- You can increase your borrowing capacity by consolidating debt – helpful if you are aiming for your next investment property or first home.

- First home buyers can get into a home sooner by reducing their total debt obligation.

- Reducing your total monthly expenditure will allow you to be debt-free sooner.

- Having several loans and payments due with multiple providers is hard to keep track of.

- Missing a payment as well as simply having multiple ‘credit facilities’ open raises red flags with the banks. Even Buy Now Pay Later facilities reduce your chances of getting a home loan.

- If you are a homeowner, you can add your debts to your home loan – providing access to home loan interest rates which are much lower than personal loan, credit card, vehicle finance rates.

How Does Debt Consolidation Increase Your Borrowing Capacity?

Having a Platinum Airpoints card with a $20,000 limit might seem great for the status and points you’ll accumulate for your next winter holiday. The overdraft you never use, and your student loan that’s still ticking away because its interest free might be forgotten, but there’s no need for concern – is there? A couple of store cards that also are interest fee (not excepting hefty ongoing service fees) do no harm when buying your first home or investment property, right?

Unfortunately, if you apply for a home loan you will be ‘tested’ as if all your credit is “maxed out” to the limit each month. This restricts your borrowing capacity as we enter into the serviceability calculators the limit – not your current balance or whether the debt is interest-free! And it gets worse when trying to apply for a mortgage. Your total debt is tested at a margin around 3% above the current 12- or 24-month interest rate – this is over 9.5% currently. The banks factor in a safety margin for their peace of mind 150% above your current monthly repayment amount to be sure you can repay their loan and meet all your current financial obligations. The higher the total amount of consumer debt the less you will be able to borrow for a home loan.

There is no firm number how much debt consolidation will help you, as this depends on the type of debt. A student loan will hinder your borrowing ability different to a credit card. Students loan repayments per month are linked to your salary – which differ depending on your income. Generally, for every $10,000 increase in your credit card limit, your borrowing ability will decrease by $40,000 or so. Having an overdraft limit on your bank account is tested and included. Having a $100,000 revolving credit, flexi, redraw home loan account is included within your total debt obligation calculations – if your balance available is $25,000…you are tested as if you have drawn the full $100,000.

How Debt Consolidation Can Help First Home Buyers.

If you are trying to get into your first home currently and have been to the bank or are thinking about buying a home sometime in the next few years, you should contact a Financial Adviser now. We can put a plan in place for you to get into your first home and model exactly when you will be moving in – down to the nearest month! If we need to consolidate debt to achieve this, the options we recommend will be explained to you. By showing banks your improved financial maturity and savviness, “we don’t have multiple credit & store cards, buy now-pay later and personal loans…” we are showing the bank or lender we are good candidates to repay a 30-year mortgage. The lenders appreciate you have taken advice and have a plan to ‘get ahead.’ Your financial savviness will come through when we show your consolidated debt and how this will be repaid sooner than had you not taken any advice.

By reducing your total debt obligation, either through reducing limits or closing credit cards and using a calculated amount of your savings to repay some debt, we will have an exact framework in place to get you to your goal of home ownership. Quite often we include a student loan into a new consolidated loan, as the monthly repayments hamper your borrowing ability.

First home buyer case study:

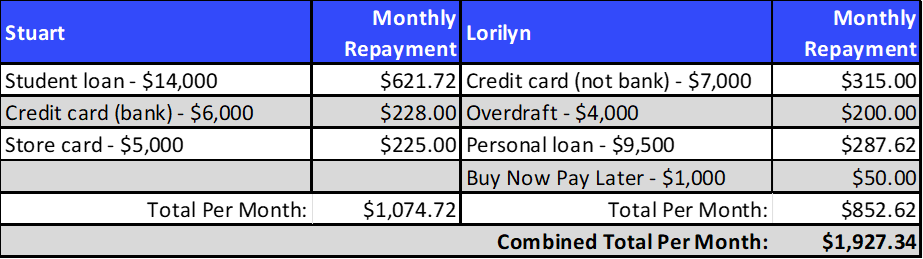

Stuart and Lorilyn both work full-time and earn $85,000 and $72,100, respectively. They have saved $91,500 deposit combined in savings and KiwiSaver. They are looking for a new-build home to live in with their two children for around $750,000 purchase price in Auckland.

They have the following debts:

In their current position they would not be able to afford their first home for $750,000; requiring a home loan of $660,000 plus their $90,000 deposit. This is due to the banks ‘testing’ their loan affordability as if they were at the limit of all their cards and loans. This affects their serviceability for a home loan. They are paying nearly $2,000 per month in expenditure that cannot go towards their mortgage.

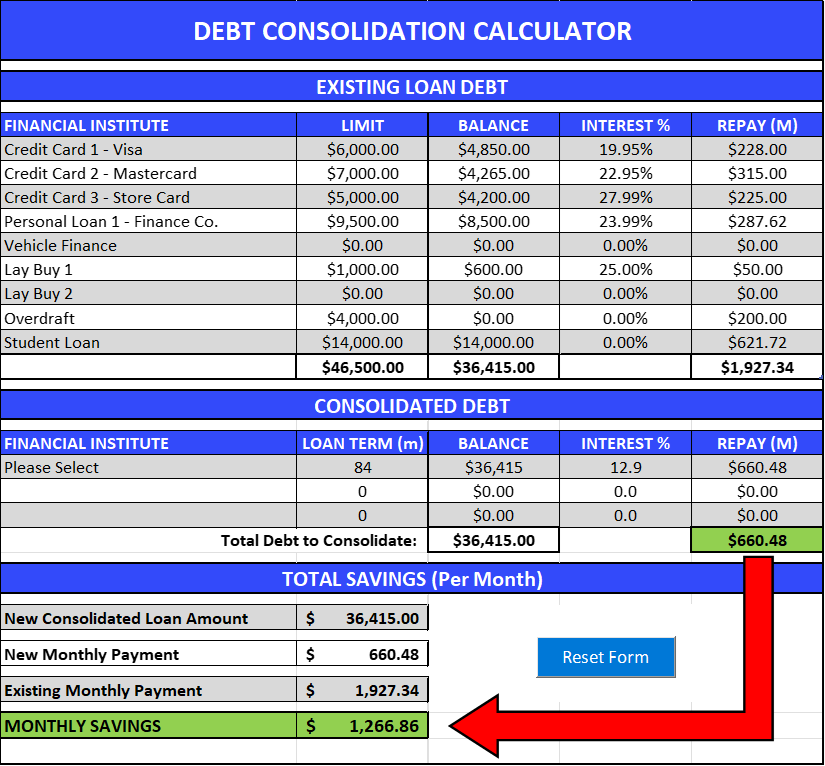

Using our debt consolidation calculator we were able to save them more than $1,200 per month. As they don’t yet own a home and have no family that can assist them further, we consolidated their debts (even Stuart’s student loan) into one loan with new monthly repayments of $660.48 per month. We next closed their overdraft which wasn’t being used and repaid their Buy Now-Pay Later with savings.

This allowed them to pass the bank serviceability tests and purchase their first home for $750,000.

How Reducing Your Expenditure Allows You to be Debt-Free Sooner.

The rate you pay off your debt has a greater effect on becoming debt-free quicker than the interest rate you pay. If you direct more of your income towards your debt, you will clear debt quicker. You can increase your surplus income and reduce your monthly expenditure substantially through exploring debt consolidation options. No need to get a second job, work more hours or start that side hustle. In our First Home Buyers example above, they increased their income by over $1,200 per month, this is approximately $100,000 more borrowing power!

Let’s check the maths using the $660,000 home loan from the above case study:

- Say you can get into your first home with a mortgage costing 0.75% higher interest rate than your ‘neighbour.’ You will be paying 7.75% per annum in interest.

- For the same loan amount, your neighbour is eligible to receive an interest rate of 6.99%.

- After 24 months your balance is $647,949.28 versus $646,080.57 for their loan.

- If you make extra repayments of $500 per month – this could be from the cost savings you made through consolidating your debt – you will now only owe $635,014.35.

- Even a $200 extra payment per month will result in a balance of $642,775.31 after two years.

Missed Payments, Multiple ‘Credit Facilities,’ including Buy Now-Pay Later are Red Flags to Banks.

Mortgages have been declined by customers’ own banks due to a simple missed phone bill. We know life is busy. Why make things hard with multiple payments due at various times with different providers. When the banks are busy, they can say ‘No!’ Missed payments are recorded on your credit file. Remember, we are showing the bank or lender you are a suitable candidate to repay a 30-year mortgage when we apply for your home loan.

We Know It’s Difficult Keeping Track of Multiple Loans.

Another common hurdle that can trip you up is non-disclosure or forgetting that you have a personal loan, credit, or store card and Buy Now Pay Later for example. If the bank or lender ask “does your customer have a store card with…” then that’s not a good look. They will be thinking what else might have been forgotten and how are they going to remember to pay our mortgage each fortnight.

Unlocking Homeowner Benefits: Leveraging Lower Interest Rates by Consolidating Debt with Your Home Loan.

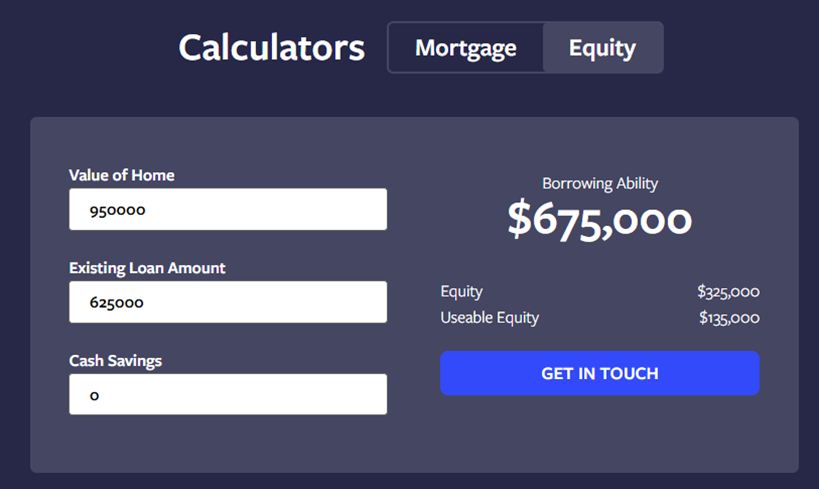

Yes. It can be amazingly easy and straightforward. We can quickly tell you if can only consolidate debt into your home loan by determining your useable equity and loan serviceability. You can check your useable equity on our Mortgage Repayment Calculator and selecting the ‘Equity’ tab. Here’s a step-by-step example showing how to calculate your equity and useable equity:

- Click ‘My Equity’ calculator & select the ‘Equity’ tab.

- Enter the value of your home from co.nz

- Enter your total loan balance.

- Enter any additional savings you may have.

This client has $325,000 of equity. Think of this as how much they would receive if they sold their home for the above value and repaid their home loan.

Their useable equity is $135,000. This is how much they can increase their home loan by, subject to loan serviceability – which means…can they meet the repayments of a home loan totalling $760,000 ($625,000 + $135,000).

Examining the Flip Side: Weighing the Drawbacks and Exploring Alternative Perspectives on Debt Consolidation.

Debt consolidation can be a powerful tool for individuals striving to overcome consumer debt, but it’s essential to carefully assess the factors involved. We always recommend this option for clients who are trying to get ahead and clear their consumer debt, and will caution against unnecessary accumulation of further debt if it can be avoided. Consider the following points and get in touch to discuss any questions you may have further with us:

- A consolidated debt with a longer loan term may take longer to repay. If you simply repay the new debt at the lowest repayment amount, you could end up paying more loan interest and be in debt for longer. We will show you the best way to reach your financial goals, what repayment amount per month is achievable – including with an increase in loan term and /or debt level.

- To be eligible for the best interest rates you may require security for the loan. Having the loan fully, or partially, secured by a vehicle for example will reduce the interest rate offered to you. Adding the consolidated debt to your home loan allows access to home loan interest rates.

- Consolidating consumer debt into your home loan should only be done if this is part of an overall Financial Plan to get you ahead. You should at the least be given an easy-to-follow plan to be completely debt free as soon as possible according to your financial circumstances.

- You can only consolidate debt into your home loan if you have enough useable equity. Adding to your home loan will reduce your useable equity.

- You may need to adjust your lifestyle to match your income. Debt consolidation should not be seen as a ‘get out of jail’ free card. Can you sell assets, close credit cards, cancel subscriptions, only make purchases with cash savings, and put money aside for big ticket items rather than financing them. We understand that emergencies and unexpected events happen all the time – our financial planning can help you with this.

- We may charge you a fee, either to cover our time taken to complete the loan application or because we aren’t paid by the lender. If there is a fee involved, we will let you know during the beginning of our professional relationship and only proceed with your agreement and understanding.

We have multiple lending options in our toolkit for debt consolidation, all the main banks, most smaller banks, and every non-bank lender active in New Zealand. Additionally, there are lenders we work with on a case-by-case basis. You won’t necessarily need to change banks either if we are consolidating your debt into your home loan. Using our Financial Modelling software and the mortgage repayment calculator on our website, we show you how to get you to your financial goals sooner.

Everyone’s situation is unique, and we provide you with an individual plan in keeping with our ‘Clients for Life’ philosophy.

*Financial Adviser = Mortgage Broker or Mortgage Adviser.

Book a time to meet today if you’re thinking about debt consolidation.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.