Exploring Life and Health Insurance: Part 1 – A Priority-Based Overview

In this series of articles, we will begin by exploring the various life and health insurance options and organising them in order of priority, specifically tailored to the needs of most New Zealanders.

There are more immediate concerns that tend to occupy most of our thoughts than the far-off inevitably of death.

Depending on your age, life stage, and financial situation, these concerns often dominate your thoughts. These worries can lead to daily stress and anxiety. Insurance is a valuable tool, offering a smart way to safeguard yourself and ease financial burdens when unexpected events occur, helping you cope with the uncertainties of your future health and well-being.

Choosing the right types and coverage amounts for insurance always involves striking a balance between necessity and affordability. Our aim is to ensure that prioritising your financial future remains a top consideration, and the cost of insurance shouldn’t hinder that goal. Insurance plays a crucial role in safeguarding the milestones you’ve already achieved and ensuring that your future plans remain on course. The financial modelling we perform when recommending insurance offers an essential insight into the suitable amount and type of coverage you need, as well as how long you might require it.

Life and Health Insurance are Risk Management Tools.

There are other ways to consider managing the risks we all face in life. When we take out insurance, we pay someone else to accept a portion of our risk. The best scenario for you, is that you’ll pay a small premium to an insurance company and all you’ll ever get in return is peace of mind. The hope is that you’ll never have to make a claim, as it signifies that nothing ‘bad’ has occurred to you. However, if you do need to make a claim, you won’t have to undo all the hard work you’ve put into reaching your current financial position.

The four primary methods to manage risk:

- Avoidance: This involves taking steps to completely avoid the risk or situation that could lead to a loss. For example, avoiding high-risk activities.

- Minimise: To minimise risk, efforts are made to reduce the severity or impact of a potential risk. You might exercise regularly, eat well and get regular health check-ups – hoping to reduce your chance of sickness.

- Transfer: Transferring the risk means getting another party to accept your financial risk if the event in question happens to you. Although another expense, insurance is usually the best strategy available to offset the significant financial risk of an accident, illness or death.

- Acceptance: Sometimes we might choose to accept the risk without attempting to transfer, avoid, or minimise it. This often happens when the cost or effort required to manage the risk outweighs the potential loss.

Each of these strategies has its place in risk management, and the choice depends on your specific circumstances and goals. Transferring risk through insurance is a particularly effective strategy for many types of risks, as it allows individuals and businesses to share the financial burden with an insurance company, reducing the impact of unforeseen events.

You’re Unique: Your Risks and Their Management Will Be Too.

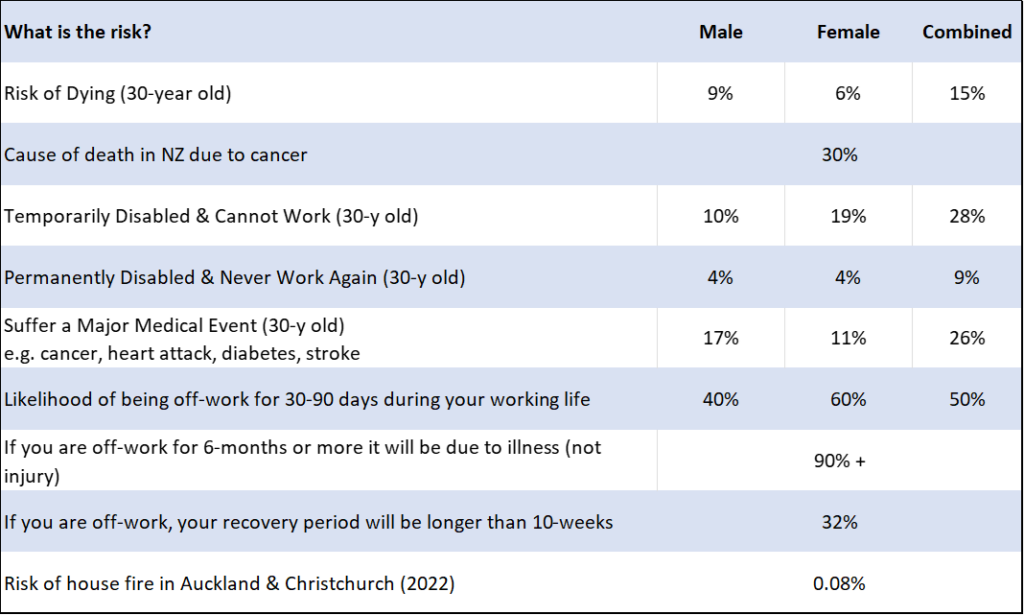

According to OECD statistics, New Zealand ranks 23rd out of 38 OECD countries in terms of life insurance uptake. The insurance industry plays a crucial role in our economy, serving as a safety net for personal and business risks. While we readily insure our cars, pets, home contents, and purchase travel insurance for overseas trips, the concept of protecting our income and health often takes a backseat. The risk of house fire is less than 0.08% for homeowners in Christchurch and Auckland (2022), and yet we’re required to insure our homes to protect the bank’s investment, however the broader idea of safeguarding our largest assets (our health and income) is still an afterthought for many Kiwi’s. Perhaps it’s time for us to collectively recognise the value of insurance in line with other developed nations as a risk management tool and move away from the ‘she’ll be right’ attitude that we often embrace.

Below is a quick summary of some statistics that underscore the fact that for many people, ‘she’ (or ‘he’) won’t be alright:

The premium you pay the insurance company is based on the risk occurring and the value of the ‘thing’ insured e.g. your car, income, or house. It’s crucial to remember that your situation is unique, and the generalisations from statistics don’t necessarily have to apply to you. Several factors will impact your individual risk and the premium, including some that are beyond your control (like family history) and many that you can influence such as diet, exercise, sports/pastimes, alcohol consumption, and smoking status.

A Brief Overview of Personal Insurance Products by Importance:

Navigating the intricacies of insurance can be challenging, making it essential to seek guidance from a knowledgeable Adviser to make it work for you in a language you understand. Below is a brief overview of the personal risk insurance products, tailored to the typical priorities of most New Zealand households.

1. Health Insurance or Private Medical Cover.

Safeguarding our health in case of accidents or injuries is crucial. Health and medical insurance offers quick access to top-quality healthcare and specialist treatments that may not be publicly funded. It also allows you to avoid waiting lists, ensuring prompt treatment before your condition worsens. Depending on the cover you choose, health insurance can help cover you for big things like seeing a specialist, surgery, or cancer treatment, as well as everyday health needs like the dentist, GP and physio. Furthermore, you have the freedom to select your preferred surgeon or specialist, which can reduce the need for multiple follow-ups and lower the risk of complications – getting you ‘on your feet’ sooner.

- Say goodbye to the anxiety and unpredictability of waiting lists for specialist consultations and surgeries. With health insurance, you’re in control, deciding when and whom you want to see for treatment.

- Don’t risk surgery delays, even for critical cases like cancer treatment, which can happen in the public healthcare system. Timely detection and treatment can be lifesaving, and health insurance ensures you receive prompt care.

- Our recommended insurers stand by their policy wordings and even enhance them over time. You won’t have to worry about benefits being removed, offering you peace of mind when it comes to making claims.

- Gain access to cutting-edge medical treatments and life-saving medications that might not be publicly funded or have limited funding due to the high demand and rising healthcare costs. There is a long list, which are Medsafe approved but not subsidised by PHARMAC (Erbitux, Keytruda, Avastin, Trikafta, Stelara, Tafinlar, Afinitor, brachytherapy, immunotherapy) which are available worldwide.

2. Income Protection Insurance & Mortgage Repayment Cover.

Income protection insurance provides you with income if you’re unable to work due to an injury or severe illness. It is the financial lifeline when your sick pay and savings can no longer sustain you. Income protection insurance ensures that you’ll continue to receive a percentage of your income until you’re medically fit to return to work or even until you reach retirement age. This essential safety net extends to mortgage repayment cover, particularly valuable if you have mortgage or rent obligations. In determining your need for income protection insurance, you’ll need to explore your current financial safety net and discuss some critical questions. How long could you survive without your regular income? What if your household dropped to a single income? And what if the illness or injury affects the rest of your working life? Ultimately, we’ll help you assess whether you and your family are well-prepared to pursue your life goals, even in the face of unexpected adversity.

Protecting your most valuable asset—your ability to earn an income—is paramount, even in a country like New Zealand with its Accident Compensation Corporation (ACC) coverage. While ACC offers essential protection in case of accidents, it’s crucial to recognise that income protection insurance and mortgage repayment cover offer a broader safety net. These policies step in to replace your income whether the event was due to illness or accident, offering a more comprehensive form of protection. This distinction is significant, considering that statistics show a substantial likelihood of being unable to work due to illness, which often entails a longer recovery period. In fact, you are 2.6 times more likely to be off work due to sickness than as a result of an accident. The impact can be swift and severe; 55% of households would find themselves unable to cover their expenses and maintain their desired lifestyle after just four weeks without income. Moreover, with income protection insurance, you won’t be compelled to return to just ‘any’ work or rely on a sickness benefit of $385 per week (before tax), as ACC mandates.

- Protect Your Greatest Asset: Consider safeguarding your ability to earn income, as it’s your most valuable asset.

- Use our ‘Lifetime Income Calculator‘: Explore your lifetime income to grasp the potential of your wealth-building and goal attainment within your lifetime.

- Income Growth Over Time: A 30-year-old earning $90,000 per year before taxes will be earning $176,460 annually at age 65*. This totals almost $4.5 million in earnings, offering ample opportunities for debt repayment and wealth accumulation.

- Flexible Coverage Duration: Tailor your coverage to your needs, whether it’s 2-5 years, until age 65, or even 70. This flexibility allows you to plan for mortgage payoff and achieve your financial goals.

*2% inflation rate.

3. Trauma Insurance or Critical Illness Cover.

Trauma insurance, often referred to as critical illness insurance, serves as a financial safety net against the impact of major medical events and illnesses, such as cancer, heart attacks, and strokes. With trauma insurance, you receive a lump sum payment upon diagnosis of a covered condition. Leading insurers typically cover 30 to 50 different conditions.

One of the primary advantages of trauma insurance is its flexibility, as there are no restrictions on how you can use the payout. Common uses include reducing mortgage debt, acquiring specialised equipment or a vehicle, covering medical expenses, making home modifications, securing support care, or creating an investment fund to replace lost income. It can also serve as a means to fulfil financial obligations for your partner until your recovery.

Moreover, as you build wealth and explore other financial options, you may have the opportunity to reduce your trauma cover amount, ensuring that your insurance aligns with your financial situation

Key Points of Trauma Insurance Coverage:

- Comprehensive Coverage: Trauma insurance typically covers a range of 30 to 50 serious and potentially life-threatening medical conditions.

- Individual Coverage: Trauma insurance is designed to provide coverage for the policyholder only. If you become ill, your partner or family members do not receive a benefit.

- Free Children’s Cover: Many policies include free children’s cover. This means that if your child falls seriously ill, the policy can provide a payout to support you during the period when you may need to take time off work to care for them.

- Total & Permanent Disability (TPD) Benefit: Top insurers include TPD as an integrated part of trauma insurance. This means we don’t have to include TPD cover separately.

4. Life Insurance Cover.

Life insurance is a cost-effective means of support for you or your family in the event of your death or a terminal illness diagnosis. It offers the choice between a lump sum payment or regular monthly instalments, allowing you the flexibility to utilise the payments as required. When determining the appropriate level of coverage for you and your family, we typically consider various aspects, including:

- Repay mortgage debt.

- Funeral costs.

- Future education expenses.

- Inheritance or donations.

- Repatriate loved ones.

- Restructure business affairs.

- Hire home help.

- Create an investment fund.

5. TPD Cover.

TPD (Total and Permanent Disablement) cover involves a lump-sum payout to the policyholder when a permanent change in health occurs, with little chance of recovery to previous levels. This coverage steps in when an individual faces a complete loss of capacity to work or carry out daily tasks due to illness or injury. Its primary purpose is to mitigate the severe financial consequences that come with a permanent loss of income. The financial impact can be substantially more daunting than the loss of a partner, as it encompasses ongoing daily living and substantial medical expenses for the disabled individual.

How To Deal with Stress from The Unknown.

It can feel pretty stressful when you don’t know what’s around the corner – and none of us can predict what the future holds. A sudden diagnosis might lead one person back to work in a matter of weeks, while another may face a long-term disability, altering their ability to work indefinitely. Insurance policies act as a crucial safety net, offering significant benefits to policyholders and their loved ones. It’s the unpredictability of life’s journey that underscores the essential role insurance plays in providing both financial security and peace of mind amidst life’s unpredictable twists and turns.

Ready to take control of your future well-being by exploring insurance options tailored to your needs?

Contact us now to start your journey towards a more secure and stress-free future.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.