First Home Buyer’s Mindset: Unlocking the Door to Homeownership

Your Journey to a Financial Goal is Unique. “When you align all actions to a single outcome, and you keep working at it, your success will look effortless and obvious to the outside.”

Set yourself up for success, before you start shortlisting properties and planning what you’ll do with your quarter acre. Seek out experts and accept help. In fact, we’re here to guide and plan your homeownership journey right from the moment you start your career!

Your journey to achieve a financial goal is personal and unique. Only you know the struggle and sacrifice involved. To outside observers, they will only see the end result. This underscores the importance of delving into the mindset necessary for homeownership success. We assist individuals from diverse backgrounds and circumstances in achieving homeownership. We have helped young couples starting out on the property ladder. Additionally, we have worked with large families, solo buyers, and people in their 50s. We dedicate ourselves to helping everyone achieve their dream of homeownership.

You don’t need 10 years to do something spectacular.

Almost universally, we tend to overestimate what can happen in the short term and underestimate what can happen in the long term. It is possible to achieve remarkable things in a much shorter timeframe. The key lies in setting clear goals and taking consistent action towards them. By breaking down your larger objective into smaller, manageable tasks, you can make steady progress. Each step forward brings you closer to your ultimate goal, building momentum along the way. With determination and focus, you can accomplish extraordinary feats in a fraction of the time it may initially seem. Many entrepreneur and successful business ventures offer valuable parallels for those pursuing personal goals, like acquiring their first home.

Planning Your Path to Home Ownership.

Many E-books, financial gurus, and podcasters echo a familiar narrative for aspiring first-time homeowners: manage money, pay off debt, lower expectations, consider moving back home, ‘clean up’ accounts, cut unnecessary spending, and save for a substantial deposit. However, what if you’re ready right now? At our service, we treat all first home buyers as if they are prepared to buy immediately—some actually are. For others, this approach provides valuable experience and a precise timeframe, down to the nearest month, for when they can buy their first home. This firsthand insight makes the entire process less daunting when they decide to buy in the future. And they know the exact one or two fixes required. Our first home buyers E-book ‘First Home Masterplan’ is a little different. Our ‘Clients for Life’ philosophy means we will work with you at whichever stage of the process you are at.

Seek Help. Early.

You are buying a home for the first time and can’t expect to know everything. Surround yourself with experienced people to help you do it right. Mortgage Brokers and Financial Advisers work for you but are paid by the bank or lender. Some ‘Brokers’ might not put in much effort if you cannot buy immediately. They won’t be getting paid anytime soon. A Financial Adviser, on the other hand, guides you through everything. They help you determine how much you can borrow. They also assist with navigating the buying process and assembling your ‘team’. They also assist with a plan to repay the mortgage. They can help you find the appropriate amount of personal insurance. They make sure you have what you need to create wealth and family memories. They offer support if unexpected challenges come up on your journey. The earlier you seek help, the sooner you will be on track to home ownership.

Mortgage Mindset.

Facing financial assessments in a home loan application can be sobering. It’s a reality that you must confront. Online calculators may give a rough estimate – and lead to high hopes. However, a formal application process examines expenses thoroughly. This guarantees a more precise evaluation. Your Financial Adviser can do this without applying to the bank. Being prepared is crucial for potential adjustments to your initial expectations. These adjustments may include delaying your home purchase or revising the loan amount. This process can be unsettling. However, it will connect your desire to own a home with your financial capacity. It promotes long-term stability and successful homeownership.

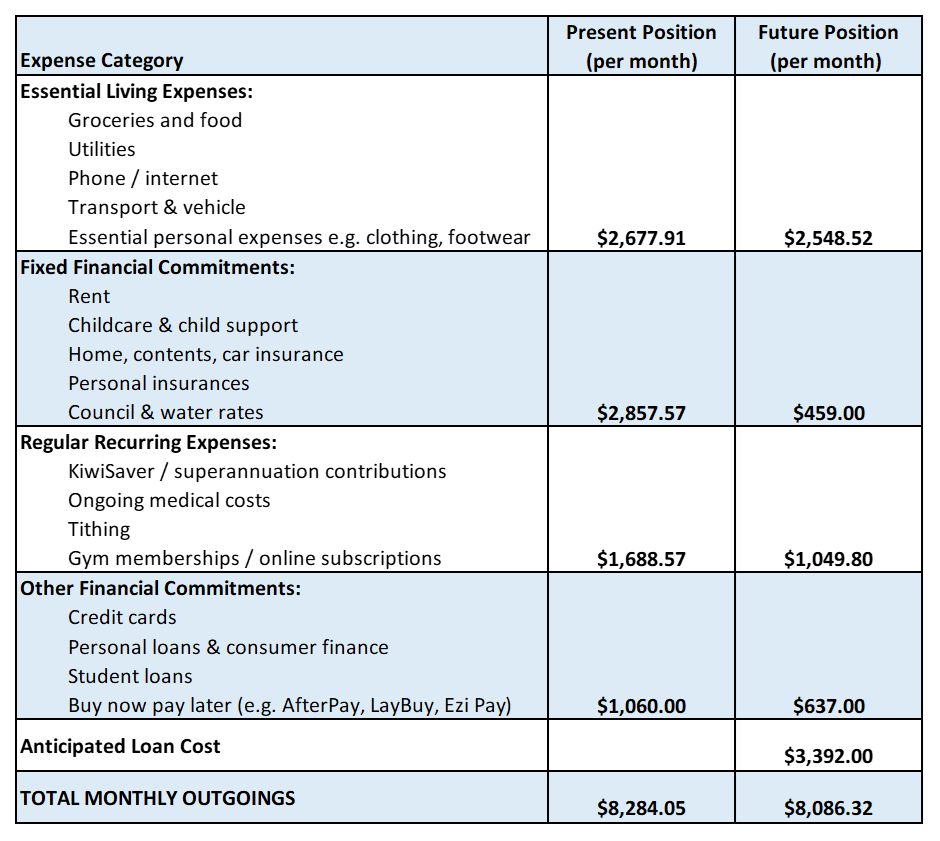

Here is an outline of how most banks categorise monthly expenses for consideration. It’s useful to consider these at an early point in your home buying journey. Schedule a discussion with a Financial Adviser. Understand how to make beneficial changes to improve your position. Apply those changes as soon as you are able.

Believe. Keep Your Positive Mindset.

Stay motivated to buy your first home. Protect it from life’s challenges. Shopping for a home and comparing mortgage rates is a journey. It doesn’t exempt you from life’s ups and downs. Having the right team increases your chances of success. The process becomes less exhausting. Even in challenging situations, you can navigate them without compromising your well-being. When you feel overwhelmed, stay positive-minded. Your Financial Adviser has a lot of experience helping people like you. They are there to guide you through every step. A positive mindset contributes to emotional well-being. It also helps with resilience and navigating challenges. These are all essential for success in reaching goals like homeownership.

Be Coachable and Willing to Learn.

To become a homeowner, you need a growth mindset and willingness to learn. To successfully navigate this journey, listen to advice from experienced professionals. Embrace opportunities to expand your knowledge: understand market trends, master home buying intricacies and jargon. Having a coachable spirit accelerates your learning curve. It also positions you for long-term success in this field. There’s no need to master every detail immediately, aim for a fundamental level of knowledge that empowers you to comprehend the subtleties of the process and make informed decisions as you progress toward homeownership.

Navigating Homeownership with Confidence.

We follow a philosophy of ‘clients for life’. We understand that every situation for first home buyers is unique. Our commitment goes beyond transactions. It’s about establishing enduring relationships. Trust and understanding build these relationships. They aim to build your confidence. We understand that everyone’s situation is unique. That’s why we create personalised plans that match your goals and lifestyle. Your journey to homeownership is not a transaction; it’s a partnership. We’d love to help.

Embrace the Mortgage Mindset! Contact us to start your journey to homeownership today.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.