Five Tips to Maximise Your KiwiSaver in 2024

Traditionally, in January, we look at our current position. We make big decisions about what to change in the upcoming year. Whether our goal was to lose weight, pay off the mortgage or increase our retirement savings unfortunately, we sometimes falter by February. There are strategies that actually work to enhance our chances of success.

These strategies can help us put away more for retirement. Instead of ‘folksy’ or short-term advice, let’s keep things simple and smart as we plan for the year ahead and beyond.

Now is a great time to grasp the workings of KiwiSaver and consider your investment in it. As money is the biggest concern for over half of New Zealanders. We’ve devised five practical tips for KiwiSaver members to use to help strengthen their accounts in 2024. You should never delay taking proactive steps to manage one of your most substantial and crucial assets.

1. Make Sure You’re in the Right KiwiSaver Fund.

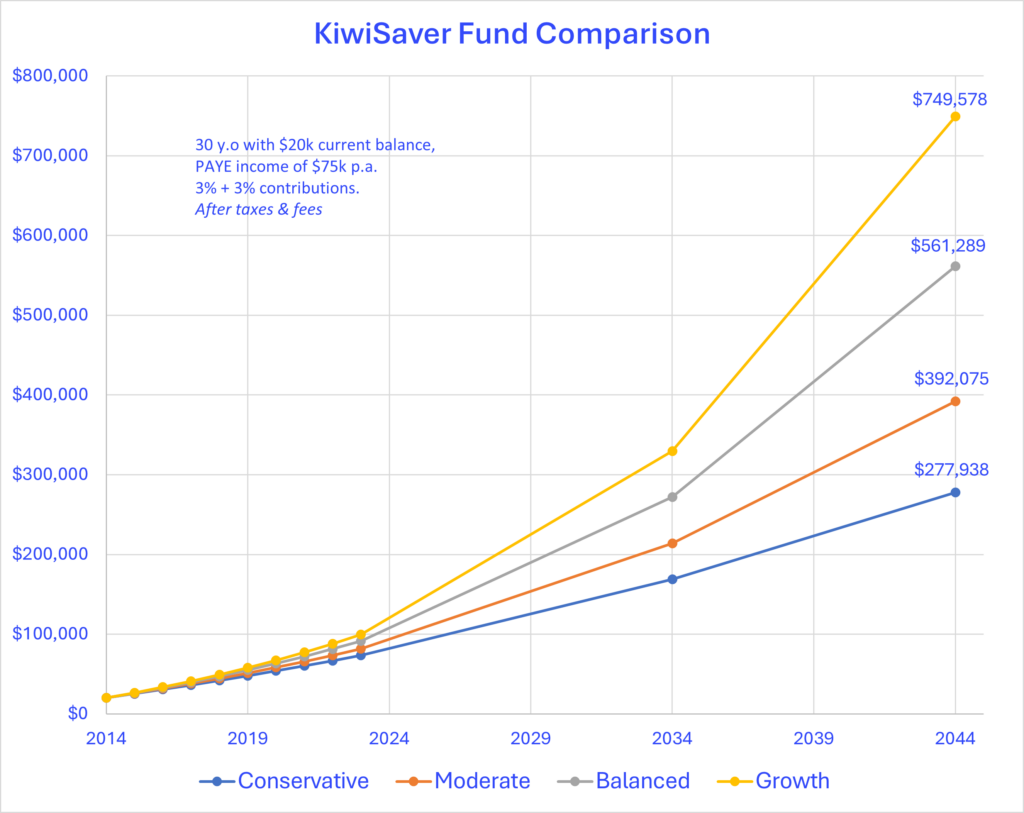

Your KiwiSaver fund should be appropriate to your savings goals and timeframes. Most providers offer a range of investment funds, each with its own risk and return profile. We can select one, or more, where our savings are allocated to. Take the time to understand these options and select a fund that best matches your risk tolerance, investment horizon, and financial objectives.

The five main KiwiSaver fund types and recommended minimum investment timeframe are:

- Defensive | 0-3 years

- Conservative / Moderate | 2-5 years

- Balanced | 5-8 years

- Growth | 7-10 years

- Aggressive | 10 years +

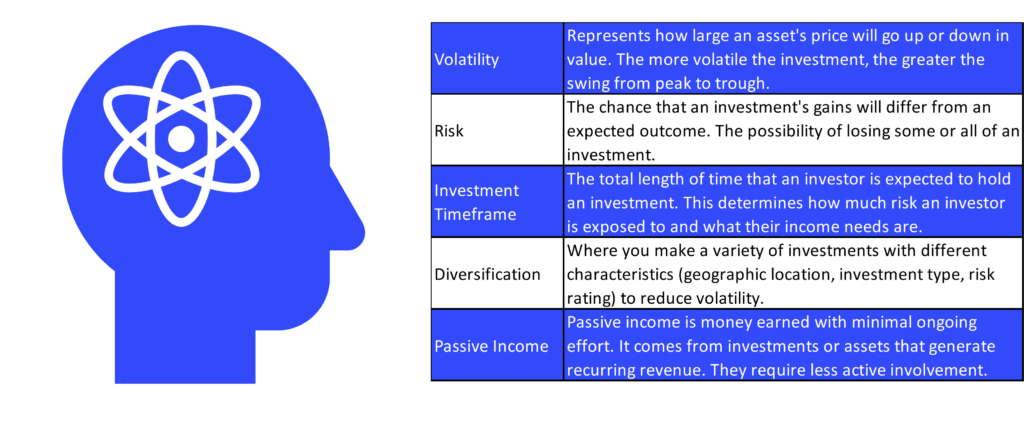

To maximise your KiwiSaver fund, it’s a good idea to choose the right type of investment appropriate to your savings goals. If you’re 15-20 years away from retirement or not planning to make a withdrawal soon (e.g. for your first home), a growth fund may be a better option for you. Overtime, growth funds tend to outperform the other fund types, leaving you with more in retirement or for your deposit. Remember, if you select a higher proportion invested in growth assets, this will typically mean greater ups and downs in value (volatility). This makes the investment more likely to produce a negative return in any given year.

If you plan to make a significant withdrawal from your KiwiSaver at age 65, or if you want to make a withdrawal for a first home within the next 5 years, a more conservative fund type may be better for your KiwiSaver.

A simple change in the type of investment fund, could add thousands to your KiwiSaver balance. You don’t have to do a thing.

2. Establish Your Retirement Income Goal.

Have you envisioned your ideal retirement lifestyle? Does it involve regular overseas travel or owning a beachside bach. Or does it involve living within your means with enough financial freedom to choose how you spend your time? Many people don’t think about how they’ll spend their time in retirement. Yet, it’s crucial to consider. After all, the primary occupier of your time—work—will no longer be a factor. And we are living longer than ever, which means retirement may last upwards of 30 years!

To start shaping your retirement future, reflect on key questions:

- When do you aim to retire?

- What annual income do you aspire to have during retirement?

- What savings or investments will be necessary to generate this income?

By addressing these questions, you’ll better understand your retirement aspirations. You’ll also be more equipped to work toward achieving your financial goals.

3. Review and Double Check Your Contribution Rate.

Contributing more to KiwiSaver is a great way to boost your savings balance. If you increase your KiwiSaver contribution rate to 6 or 8 percent from 3 or 4 percent, you could potentially have hundreds of thousands of dollars more in retirement. Most gains will likely come from market appreciation over time. However, it’s important to model different scenarios for you. We shouldn’t only discuss the benefit of increasing your contribution rate. We need to understand how much is feasible to contribute and take into account your mortgage debt and other investments.

The more you put in now means the more time it has to grow. Thanks to the power of compounding returns, you’ll have more in the long term. Chat with your employer to increase your contribution rate. If you are self-employed, you choose how much you contribute. You can increase your regular contributions via direct debit or make extra deposits from your bank.

4. Diversify Your KiwiSaver Investments.

Many Kiwis may not realise they are invested in the New Zealand market. They are invested through their home, job, and bank deposits. It is crucial to assess where you have allocated your KiwiSaver account. Diversifying across various asset classes, including international shares, can offer a buffer against significant disruptions to the domestic economy.

Examine your KiwiSaver scheme provider’s investment allocations. Gain insights into the advantages of diverse investment strategies. Broadening your investment horizons ensures a more resilient and well-balanced financial portfolio.

A simple change in the type of investment fund, could add thousands to your KiwiSaver balance. You don’t have to do a thing.

5. Play the Long Game for Financial Success.

Most KiwiSavers are in it for the long run. So, it’s crucial to overlook short-term market fluctuations and prioritise long-term growth. Loss aversion is a psychological tendency. We detest losses twice as much as we enjoy gains. In other words, losing something has a bigger emotional impact than gaining it. The joy or satisfaction from acquiring something is less powerful. This tendency related to our investments could lead you to make detrimental decisions to avoid a loss. This could affect your long-term returns. Remember it’s a long game.

Understanding loss aversion is crucial in navigating financial decisions and investments. Look past the short-term ‘noise’, prioritise regular contributions, and invest for long-term growth. Welcome short-term market volatility, as it holds the potential to yield large benefits in the future.

Seeking KiwiSaver Guidance?

Count on Meta Financial Solutions for expert advice! We are independent Financial Advisers who have partnered with three of the top KiwiSaver providers.

As KiwiSaver specialists, we’re dedicated to maximising the potential of your investment. Our team provide clear and confident KiwiSaver advice tailored to your needs. We are committed to helping clients identify their optimal KiwiSaver strategy. We tie our success to yours, ensuring a vested interest in your financial well-being.

Let’s navigate your KiwiSaver journey together, with your success as our ultimate goal.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.