How to Buy a House with a 5% Deposit – First Home Loan

You could move into your first home without a large deposit. You may qualify for a First Home Loan and be able to buy with a 5% deposit.

The First Home Loan is a program offered by Kāinga Ora. Because they underwrite the loan, it allows lenders to provide loans that would otherwise sit outside their normal lending criteria. This means it’s now even easier to buy your first home with a deposit of just 5%.

Your Home Ownership Dreams may Become Reality Sooner than You Think.

The First Home Loan is a home loan initiative requiring a minimum 5% deposit rather than the standard 10 to 20 per cent of the home’s value. This is an excellent option if you don’t have enough savings for a 10-20% deposit. From June 1, 2023, the banks will be able to lend to more borrowers with less than 20% deposit. The RBNZ have lifted the cap, from 10 per cent to 15 per cent, of new mortgage lending for the banks. This is great news for first home buyers with a deposit of at least 10% or greater. If you are eligible, you may not have to wait until you reach 10%, as you may meet the criteria for a First Home Loan and be able to buy now with 5%.

Check Your’re Eligible for a First Home Loan.

You will need to meet the lending criteria of the participating bank or lender. They have their own conditions we will assess you on as part of the application which include your ability to repay the loan, current level of debt, and credit history. We will assist you to determine if you qualify or put a plan in place if you don’t quite right now.

Kāinga Ora’s eligibility criteria is as follows:

- Have a 5% minimum deposit (see next section 👇).

- Be a New Zealand citizen, permanent resident, or a resident visa holder who is “ordinarily resident in New Zealand”.

- Be a first home buyer, or a previous home owner in a similar financial position to a first home buyer.

- Have a before tax income from the last 12 months of:

- $95,000 or less for an individual buyer without dependants; or

- $150,000 or less for an individual buyer with one or more dependants; or

- $150,000 or less (combined) for two or more buyers, regardless of the number of dependants.

- Be purchasing a home for you to live in as your primary place of residence.

- Not own any other property or land, this does not include ownership of Māori land.

- Be purchasing a property of less than 1 hectare

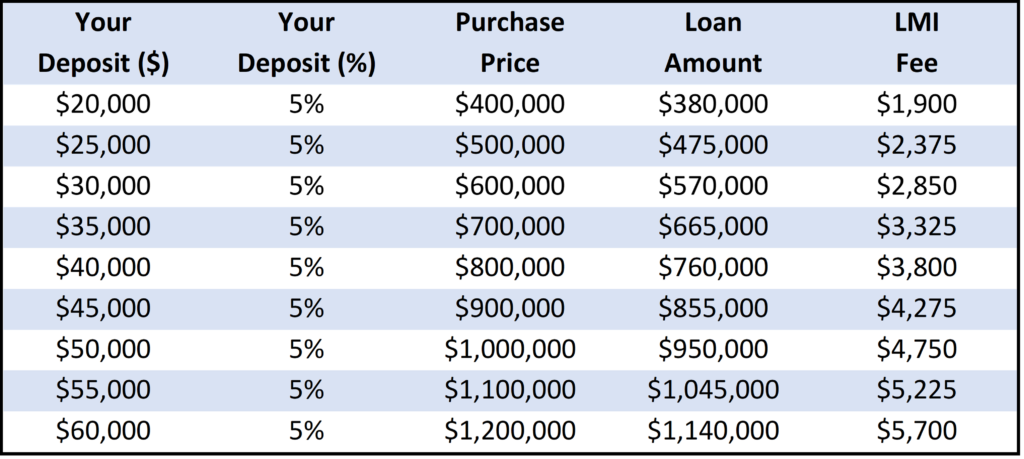

- Pay a 0.5%* Lender’s Mortgage Insurance (LMI) premium and loan application fee

(if applied by the lender).

*The LMI premium will decrease to 0.5% (from 1% of the loan amount) on 1 June 2023. The LMI can be added to the loan so rest assured you don’t have to find another couple of thousand dollars.

5 Forms of Deposit for Your First Home Loan.

Want to know what you can use for your deposit? Thousands of New Zealander’s have achieved their goal of buying their first home before you. Rest assured that its achievable for you too. And you don’t have to save all the deposit as cash in your bank account. Of the many first home buyers we have helped, only a small percentage buy their first home entirely from savings in the bank. There are other deposit options if you are not eligible for the First Home Loan, such as a Guarantee against the family home (thanks mum & dad) or borrowed money to top-up your deposit.

Here are the 5 forms of deposit for the First Home Loan that we see buyers pull together:

- Cash savings or term deposit funds.

- KiwiSaver first home withdrawal.

- Gifted* money from friends or family.

- First Home Grant of up to $10,000 from Kāinga Ora.

- Cash from sale of an asset such as a car.

*A gift is money that you do not have to repay. This is declared to the lender. A loan is usually repaid, and we must account for how and when this will occur to meet loan servicing requirements.

Our team complete the assessment to determine what size home loan you can afford. If you have $40,000 total deposit for example, we ensure you pass the bank or lender servicing criteria for a $760,000 mortgage. If successful, you can buy a home worth $800,000.

Which Banks & Lenders Provide the First Home Loan?

Want to know which bank provides the First Home Loan or if you have to use your current bank? There are multiple options we can work with. As it is the bank or lender that assesses the application and makes the decision, we work with the option that is the best for you. And it doesn’t have to be your current bank! Additionally, some banks and lenders will allow you to build a new home. The four options below in bold partner with Advisers for the First Home Loan.

Participating lenders:

- Westpac

- The Co-operative Bank.

- SBS Bank.

- Unity Money.

- KiwiBank

- Nelson Building Society.

What is the Maximum House Price we can Buy?

The Government removed the house price caps on the maximum purchase price of properties in the 2022 budget announcement. This means you can buy a first home costing any amount using the First Home Loan as long as the loan is affordable.

Income Caps are still in play as well as caps to be eligible for the First Home Grant for your deposit.

How do you know if we have a 5% deposit?

See the table below to reference what your total deposit could buy you as well as the LMI fee based on the loan amount shown (not the purchase price):

What will Our Mortgage Repayments be?

A huge advantage for the First Home Loan is you are eligible for the special interest rates on offer from the bank or lender. Check the latest mortgage interest rates here and then use our Mortgage Calculator to enter your deposit and the loan amount to see what your loan repayments will be. Don’t forget to add the LMI to the loan amount.

Once you are unconditionally approved to buy your home, we discuss interest rates and loan structure with you. Note that the interest rate you pay may be different if interest rates have changed or you select a different loan product type such as a floating loan. Using our Financial Modelling software, we recommend a loan structure to minimise interest paid and get you mortgage-free as soon as its achievable. So don’t worry if interest rates increased since you started house hunting. Lastly, our team prepare the final documents outlining your home loan’s structure to be returned to the bank and your solicitor in time for settlement and move-in day!

Why use a Mortgage Broker to Apply for a First Home Loan.

It’s a service free to you. We are paid for our services by way of commission from the bank or lender after your first home settles. We make the application hassle-free by getting everything organised well in advance. As we work with the main providers of the First Home Loan and they all have very different lending criteria, you may sell yourself short by only approaching one of them. There are many more requirements to be approved for the First Home Loan that each lender requires. Don’t worry, we are up to date with the regular policy updates and announcements and will quickly let you know if you qualify.

We will show you how to be mortgage-free sooner, save (often hundreds of thousands) on loan interest and model your financial situation and goals to age 100. Every customer’s situation is different, and we provide you with an individual plan in keeping with our ‘clients for life’ philosophy.

For every new customer that we help buy their first home we donate to Trees that Count. This helps ensure all New Zealander’s can enjoy our beautiful country by planting trees and restoring habitat throughout New Zealand.

If you’re ready to talk to about whether you qualify for the First Home Loan book a chat today or phone Mike on 021-402-508.

If you’re ready to talk to about whether you qualify for the First Home Loan book a chat today or phone Mike on 021-402-508.

Quick FYI: Mortgage Broker = Mortgage Adviser.

Book a time to meet today if you’re thinking about buying your first home or want to know if you qualify for a First Home Loan.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.