Is it Better to Fix or Float Your Mortgage?

Whether you’ve just bought a new home or you’ve received a letter from your bank to fix or refix your mortgage, the question of whether to fix or float will inevitably arise. Making the right choice for your financial future is worth getting advice on.

In the ever-shifting landscape of interest rates and the housing market, one of the decisions many homeowners agonise over is whether to fix or float their mortgage.

Each time there are a unique set of considerations to work through. What are your short to medium-term plans? Should you lock in your interest rate with a fixed mortgage, providing stability and predictability? Or should you float, potentially reaping the benefits of lower rates down the line? Should we split our loans to hedge our options?

In this blog, we’ll dive into the factors that can help you make the right decision for your situation, because one size definitely does not fit all. With interest rates much higher and household budgets squeezed in recent times, there’s more riding on these decisions today. As with most financial matters, the correct answer depends on your situation and your future plans.

When to Discuss Interest Rates and Fixing vs Floating in the Home Buying Process.

While the topic of interest rates is often introduced early in the home buying process, the in-depth discussion occurs very near to the end of the journey. Whether it’s the home of your dreams or an addition to your investment portfolio, we discuss loan structure and interest rates when you’ve reached the point of unconditional approval to purchase a property.

While you might have initially calculated your budget and checked prevailing interest rates, it’s important to remember that rates are subject to change, and eligibility requirements will impact the final rate you secure. As a result, the lender provides your Mortgage Adviser with specific rates when you are fully committed to the purchase. This is the moment when we explore interest rates and loan structures tailored to your unique financial circumstances. Together we make an informed decision, modelling your home purchase to align with your financial goals for the upcoming year and beyond.

Fixing or Refixing Your Mortgage: When do we Discuss Interest Rates?

Refixing your loan means you lock in a new interest rate for one or more of these accounts. The bank will fix the interest rate and repayments for the duration you select. You aren’t changing banks, this is refinancing your mortgage. Your lender should notify you 2 to 3 months before your fixed–term period ends with some interest rates on offer. This is too soon to ‘lock’ in a new rate. Treat this as a reminder that its time to start talking with your Mortgage Adviser about your options to refix or changing the way your mortgage is structured if your circumstances have changed. If your bank does not hear from you, your loan will default to their current standard floating rate.

You can check your new repayment amount using our Mortgage Calculator on our website to have an indication of your repayments when you chat with your Mortgage Broker.

Home Loan Types.

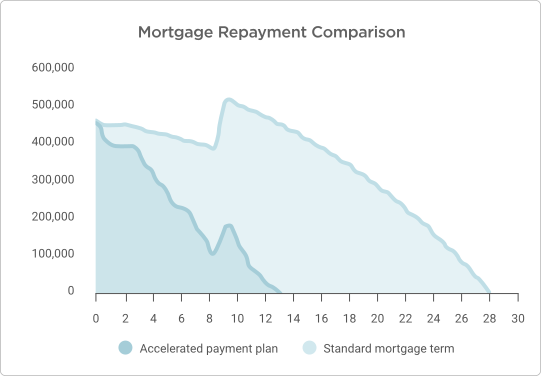

With most types of home loans you can choose either a fixed or a floating (or variable) interest rate. Revolving credit home loans and offsetting home loans have a floating interest rate. Some people will split the amount they borrow between two or more loans, one with a fixed interest rate for a certain period, the other a slightly longer period, and a third portion with a floating rate. The below mortgage repayment comparison we calculate for all our clients will show you how soon you can be mortgage free and the recommended loan structure for you.

1. Fixed Rate Home Loan.

A fixed interest rate offers the advantage of stability and predictability in your household budget. A fixed interest rate will not change during the period (term) of the fixed rate that you choose. This means that regardless of any fluctuations in the broader economy or financial markets, your interest rate remains constant throughout the fixed term. This stability can be particularly beneficial when budgeting for your increased financial commitment, as it ensures that your monthly payments stay the same. When your fixed interest rate term comes to an end, you can roll your home loan over onto a new fixed rate, switch to a floating rate, or mix and match options.

2. Floating Rate or Variable Rate Mortgage.

A floating interest rate is variable, moving in response to changes in interest rates within the broader market. This flexibility allows you to benefit when rates are low and be prepared for potential increases. With a floating rate loan, you can make lump sum payments at your discretion, without incurring any prepayment costs or penalties. If your financial situation or market conditions change, you also have the option to switch to a fixed interest rate, although it’s worth noting that certain loan types may only be available with a floating rate.

Additionally, some banks offer a valuable feature called redraw, enabling you to access money you’ve previously repaid, up to the limit of your loan account. This provides an extra layer of financial flexibility, making it easier to manage unexpected expenses or invest in new opportunities as they arise.

3. Offset Mortgage.

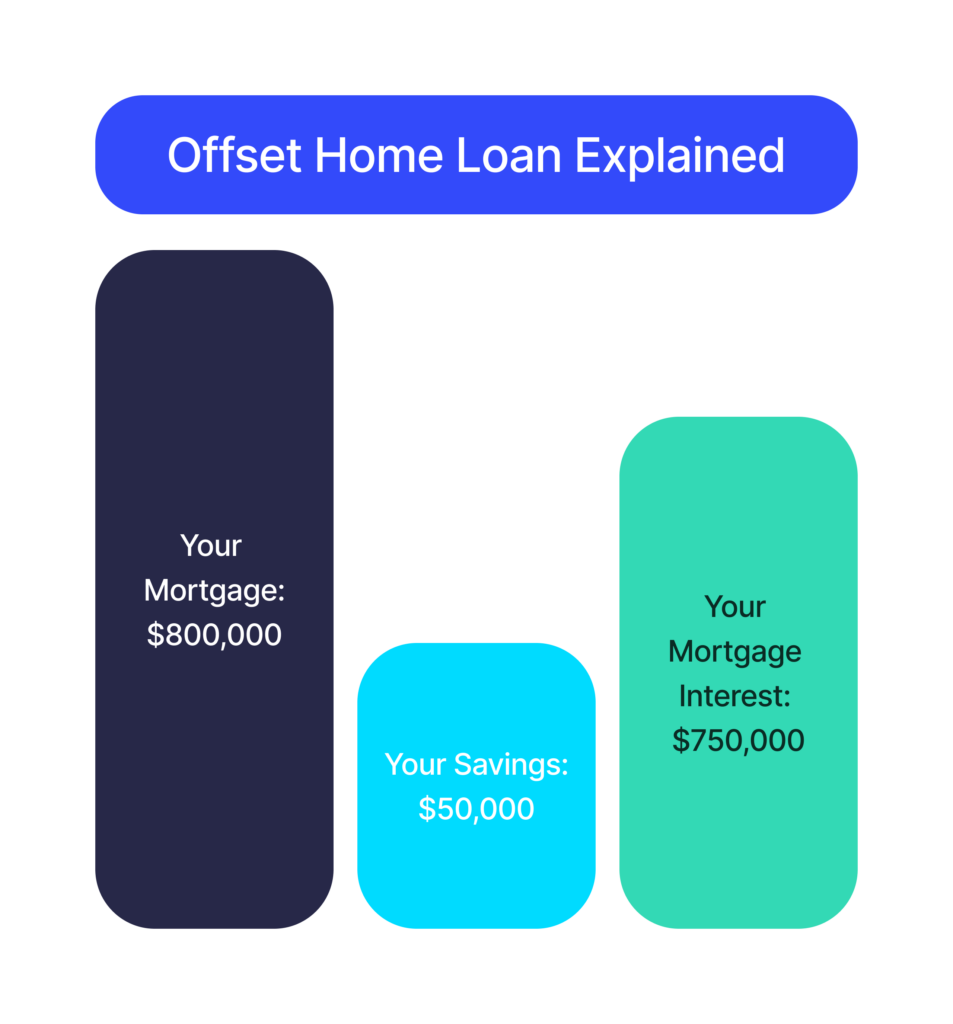

With an offset mortgage, any money in your linked savings and everyday accounts work to offset the balance of your home loan account. You will only pay interest on the difference between those accounts and the balance of your home loan. You won’t earn interest on the linked accounts. The linked home loan account will be a floating home loan. If you owe $200,000 on your mortgage, and have $50,000 in a linked savings account, you will be paying interest as if you have aa $150,000 mortgage. The greatest benefit is your savings and home loan are separate, yet there is more advantage in reducing interest on a 7% mortgage than saving at 4%.

4. Revolving Credit Mortgage.

A revolving credit home loan is a mortgage product that provides a flexible and dynamic approach to borrowing against the equity in your home. They function like a large overdraft secured by your property. They consolidate your home loan with your transaction, savings, and home loan accounts into a single account. You can access funds up to your credit limit and repay funds at any time. They are designed to save on mortgage interest by reducing your daily loan balance as much as possible reducing your home loan balance when your income is paid in.

Revolving credit home loans have a floating interest rate, which can be higher than other mortgage options, and they may also come with a monthly fee, depending on the bank. These higher costs imposed by the banks, are due to the flexibility these loans allow, and the ability to repay a 30-year home loan 5, 10, or 15 years ahead of schedule.

Revolving credit mortgages are often referred to by their bank brand names:

- Orbit Home Loan with ASB.

- Flexible Home Loan with ANZ.

- Rapid Repay with BNZ.

- GO Home Loan with AIA / Sovereign Home Loans.

- Revolving Home Loan with Kiwibank.

- Choices Everyday with Westpac.

5. Split Home Loans.

A split home loan is a strategic approach that divides your borrowing across floating and fixed interest rates, or two or more fixed periods. This approach allows you to reap the advantages of both fixed and variable rate loans and short and longer-term fixed periods. Splitting your mortgage into different types and fixed terms provides is an effective risk mitigation and interest rate management tool. The outcome can be a balanced and flexible solution to suit your specific financial needs and goals.

- Flexibility to pay off the floating portion with no prepayment costs or additional payment penalties.

- Your repayments for your fixed portions won’t change for the period you have chosen.

- You can select different terms for the fixed portion, from 6 months to 5 years.

- Splitting your mortgage enables you to hedge against interest rate fluctuations.

So What’s the Answer to the Fix vs. Floating Rate Dilemma?

The correct answer ultimately hinges on your unique circumstances. Your risk tolerance, financial goals, and peace of mind are all factors to consider. We don’t want your decision to keep you up at night! Using Financial Modelling software and our mortgage repayment calculator, we will guide you toward achieving your financial goals sooner. Once we’ve determined your financial path, the choice of home loan type and interest rate will naturally follow. We believe in a ‘clients for life‘ philosophy and know that everyone’s situation is unique. We are committed to tailoring an easy-to-follow plan with you, that suits your objectives and lifestyle.

Contact us now to discuss the best mortgage structure for your situation.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.