Navigating Property Buyouts After a Relationship Ends

This situation arises in the aftermath of relationship changes, whether it's between partners ending their joint lives, or simply friends or family who purchased a home and now seek to go their separate ways.

Addressing these circumstances can be emotionally challenging, especially when significant financial stakes are involved. Yet, it’s essential to navigate them with care, as mishandling can lead to complications and distrust between parties. We understand the complexities involved and are here to provide the guidance you need.

We often find ourselves advising in two common situations regarding property buy-outs: when a marriage or romantic partnership ends, involving jointly owned property, and more commonly in today’s world with high house prices, when friends or relatives have bought a house together and one of them is ready to move on to the next stage of homeownership.

This process of “buying someone out” replaces the need for both parties to agree on selling the property and dividing the equity. Instead, it involves one, or more, person remaining in the property and compensating the other/s for their share. The person staying in the property takes on the existing lending plus the share in equity owed to the other party, usually by way of an increased loan. The person leaving gets paid for their equity in the property.

After Love Ends with Shared Property.

When a relationship ends in separation or divorce, there are two options one may party may consider to retain ownership of the family home or other property. The person who wishes to retain these can apply to take over the current mortgage or simply apply for a new one – either with the same bank or another. Either option will require a full assessment of the borrower’s ability to repay the total lending owing, plus paying out their ex-partners share of equity, along with their existing financial commitments and expenses.

The process isn’t as straightforward as removing one party from the mortgage. We assesses the ability of the remaining party to service the existing debt, including an increased loan amount for the other party’s share. This complexity arises because due to the altered risk scenario for the bank, which require assurance that the new owner can manage the mortgage and their other financial obligations. Unfortunately, this is where the difficulty lies for individuals with varying incomes to retain the family home, let alone secure a larger loan to buy out the ex-partner. Generally, a single borrower will struggle to sustain a mortgage of half the size that two people could manage. It is important to get advice as early as possible to assess your affordability. Sometimes the difficult decision to sell the property is the best way forward to secure your financial future.

We love helping client’s model different scenarios to determine which option will get them ‘back on their feet’. Often using the equity for an investment property is beneficial, and we can compare this scenario to the alternatives.

Friends or Family Now Going Their Own Way.

If you initially partnered with friends or family to enter the property market and pooled your incomes, the process for one party to depart remains similar, usually with less emotional involvement. We’ve assisted multiple groups, whether consisting of two, three, or four individuals, in joint property purchases. Similarly, we’ve helped extended family groups of four or more members secure homes.

Often the ‘trigger’ for our involvement is when a person might wish to purchase another property with a new partner while the remaining individuals stay in the current property. Loan servicing can be smoother, particularly if two or more people continue residing in the original home. Again, we assesses the ability of the remaining people to service the debt, including the other party’s share of the equity.

How do We Determine Our Share?

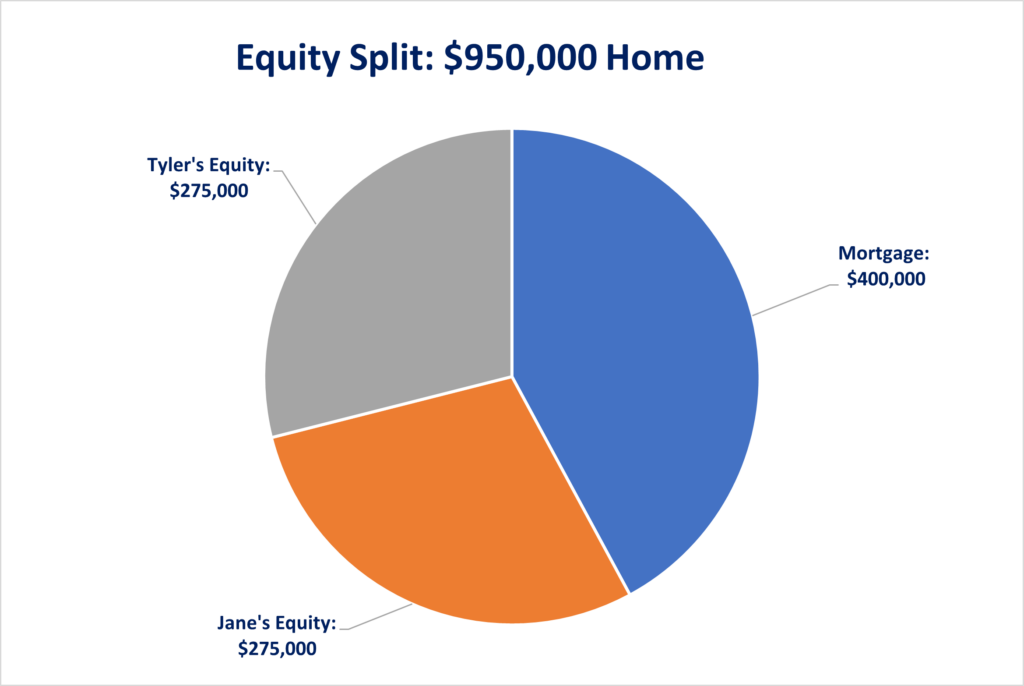

To illustrate how to calculate the necessary loan size, let’s consider a scenario involving two individuals sharing a family home. In this instance, one of them, Jane, intends to continue living in the house. The property was initially purchased with a pre-agreed 50/50 split, which was documented in a RPA with their lawyer at the time of purchase.

- Jane and Tyler own a property worth $950,000.

- Their current loan balance is $400,000.

- Their total shared equity is $550,000.

- Tyler is entitled to half of the equity, which is $275,000.

- Jane needs to service the $400,000 loan plus an additional $275,000 to pay Tyler his share of the equity – a total mortgage of $675,000.

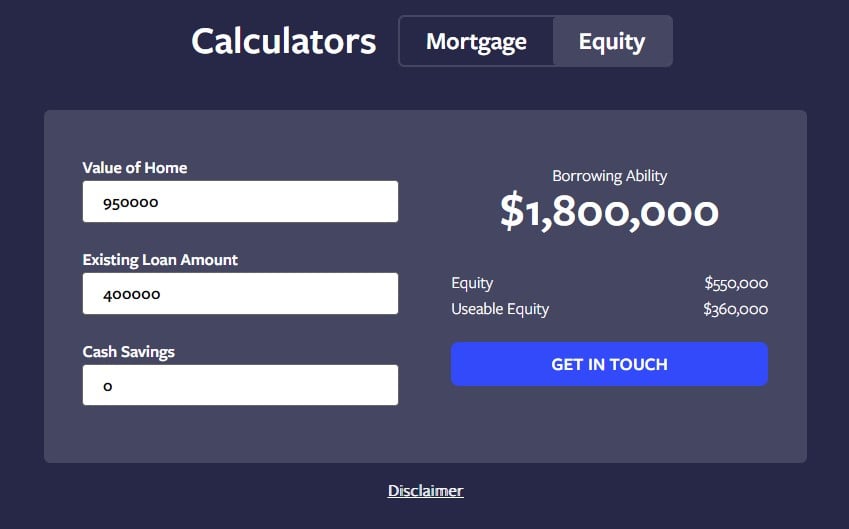

H0w Do I Calculate Our Equity?

You can easily calculate your equity by using our Mortgage Repayment Calculator.

- Select the ‘Equity’ tab.

- Enter the value of your home from homes.co.nz

- Enter your total loan balance.

- Your Equity and Useable Equity will be displayed.

Once the ‘Buy-Out’ is Agreed, What Are the Next Steps?

To proceed with the buy-out option, it’s critical to agree on the following five points. Ensuring these agreements are documented in writing and signed, ideally with the assistance of a lawyer, is important:

- Purchase price. It is recommended the purchaser order a valuation (RVR) through the bank-approved valuation-ordering system. This provides an independent valuation which will be acceptable to the bank. If you agree on a purchase price you can save money on this report. Ensure you have the agreed price in writing.

- Settlement date. Agree on a settlement date for your lawyer to document the new mortgage and transfer the ownership to the buyer on the agreed day. The person being paid out their equity share receives this amount on settlement day.

- Confirm any tax obligations. If the purchaser moves the property ownership into a trust, it’s a holiday home or investment property, the bright-line property rule may apply. Seek professional tax advice to confirm is not taxable and within the rules of a relationship property transfer.

- Child support and custody. Get the agreed custody details in writing, even if the separation is amicable. We require confirmation of any additional expenses the purchaser will have, also whether there are any changes to your income for an increase in childcare for example.

- Update your insurances. Contact your house insurer to arrange a COC from the settlement date and remove the other party from your existing insurance. Reviewing your personal insurances is paramount, as the increase in mortgage means your risk profile has changed. We are obligated to ensure you can meet your increased financial obligations should you have an accident or fall ill.

It is worth getting advice early as to what your options are and what are the necessary steps for certainty in your financial future. No matter the situation or individuals involved in a property buy-out, our role is to offer guidance and simplify the process. We’re dedicated to linking you with suitable experts and illustrating how you can efficiently progress towards your financial objectives, even during circumstances like a separation or divorce.

Click Below to Discuss and Connect

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.