5 Benefits of Using a Mortgage Broker – Plus Are There any Downsides?

If you’re looking for your first home, your third home, or you’ve had a bad experience with the bank, it’s likely you’ve heard about Mortgage Brokers. But what do we really do, and what are the benefits and potential downsides of using a Broker versus going to the bank directly? And what’s the difference between a Broker and an Adviser anyway?

By engaging with a Broker you will benefit through the significant choice, experience, and convenience offered through arranging your borrowing via a Mortgage Professional – the entire home loan process will become streamlined and simplified. And it’s more than simply getting the best interest rate, as banks largely offer the same interest rates and cashbacks.

The choice will be the ability to take your application to another bank or lender where a ‘no’ can be turned around. The experience is showing you how to save hundreds of thousands in interest, and structure your loan for you short and long-term plans. And the convenience is the ability to engage with a Broker with access to more than 20 Lenders, 7-days per week, from anywhere in the World.

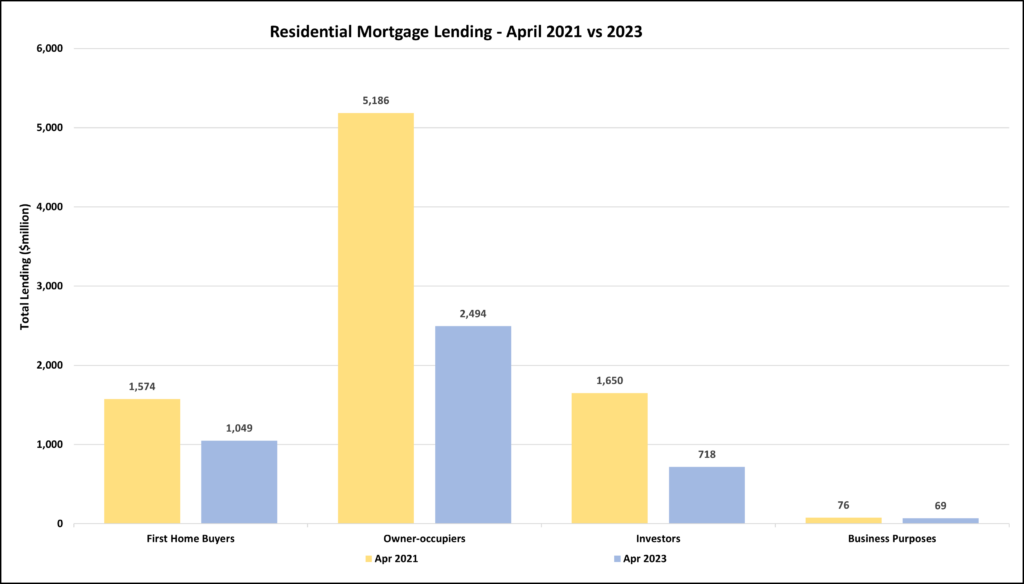

The biggest single one reason to use a Broker is advice. Bank staff cannot give advice. If we look at overseas models, banks could easily cut cost further and reduce interest to consumers by moving to a more wholesale role – no advice required. If banks were to let qualified Financial Advisers do the work to bring in business for home loan lending, this could allow bank staff to move to a data-entry role and in-house specialists to focus on business customers, Agri-lending, and support for the young and elderly citizens. In the United Kingdom Mortgage Broker originated business accounts for 84% of all home loan lending. This number is just under 70% in Australia and around 60% in New Zealand. The future may look something like this model. With over $4billion lent out in April 2023, approximately 50% less than April 2021, we think banks could work smarter promoting the use of a Mortgage Broker. As Stephen R. Covey said in 1989, this would result in a “Win-Win” for you, the banks and us as the Broker.

We’ve decided to outline the 5 main benefits – even though we could easily list 50 things that Financial Adviser does for you – plus the potential downsides of using a Broker.

1. If dealing directly with a bank, you (may) get that bank’s home loan whether it is suitable or not.

An experienced Mortgage Broker will look at your application and assess which lender will best fit your needs – within the very first conversation we can usually identify how to best help you. You will have access to a wide range of lending options according to your requirements, in the short and long term, across multiple lenders. This may be your current bank or a lender you haven’t heard of. We will look at your stage in life growing your financial security and asset base and calculate options and recommendations to present to you. The friendly staff member at the bank you are dealing with may also be able to give you a ‘yes’, the difficulty we see is that you don’t know what you don’t know. Every bank has an extensive list of criteria and internal policy on lending, sometimes updated weekly. We keep on top of this and what may have been a problem a few weeks back at your bank, is often still within policy at another bank. Very often we secure a higher loan amount – even with the customer’s same bank, due to the higher level of advice we can provide and the large variance between banks. You will also find you’re able to make a ‘cleaner’ offer when you find your next property, as you won’t have as many onerous conditions to satisfy, which often is the difference between having your offer accepted and missing out on your dream home. We will show you how to pay your loan off and reduce overall interest cost in accordance with your savings and spending habits.

An off the shelf solution from the bank may cost you a lot of money in early repayment charges, break fees and repayment of lending in the event of sale in keeping with loan-to-value ratio (LVR) requirements. This is because the bank won’t suggest you ‘split bank’ for an investment property purchase, question whether you are going to top-up your loan inside the fixed period or suggest a loan structure for additional loan repayments without penalty. They will tell you the cost if you go ahead and do one of these, however.

2. Having a Trusted Partner on Your Team is a Valuable, Lifelong Relationship.

Connecting with a Mortgage Broker is the start of a lifelong relationship. Think of them as your go-to for everything to do with your current and future financial world – an experienced hand to guide you. This connection is one that works with your team, including your Solicitor and Accountant, to secure your hard-earned income, prevent loss should anything unforeseen occur, and grow your wealth for your family to enjoy. This is a good time to introduce more relevant vocabulary in case you were wondering if a ‘Broker’ and ‘Adviser’ were the same and what’s the difference between a Mortgage Broker and Financial Adviser? Technically a Broker is the in-between person between you and the lender. The industry is relatively young in New Zealand, and this terminology (Broker) from overseas stayed with us. They may only ‘sell’ loans offered by that lender or a few lenders in aligned to their ‘head’ group*. They “broker” you a deal. You may never hear from them again.

Although we refer to ourselves as ‘Brokers’ we always try and educate our clients to the differences between a transaction-based relationship and a lifelong partnership with a Financial Adviser as your Trusted Partner.

Our clients also benefit from access to our network of other professional services – which differ depending on their requirements and future goals. We will introduce you to builders, engineers, building inspectors, surveyors, and planners if you are thinking about renovating, building, developing, or buying a property that needs work, converting from cross-lease to fee simple, or simply want to know if you can install a swimming pool. We will give recommendations for other Advisers in areas that we don’t focus on and can even recommend a great Real Estate Agent to act for you or source your next investment property. We don’t get paid for any of these referral relationships – instead we know you will appreciate the difference advice and experience can provide for you and would love for you to tell all your friends and family.

Additional services we provide for you when buying a home:

- Introduce you to a Solicitor, Accountant, Property Manager and many other professionals.

- Arrange registered valuation (RVR) reports.

- Link you with a suitable Building Inspector.

- Assist with your First Home Grant application.

- Assist with your KiwiSaver withdrawal (application submitted by your Solicitor).

- Coach you through the entire home buying process including what to do (and not to do) if you are buying by auction.

- Present your financial world in a Financial Modelling report to map your wealth creation to age 100.

*Many head groups, or Mortgage Aggregator’s, in New Zealand are owned by and/or aligned with Real Estate Companies. We feel this limits your choice and removes any independence from a very large transaction in your life.

3. An Independent Mortgage Broker will Provide Access to a Comprehensive Selection of Lending Products.

We have multiple lending options in our toolkit, all the main banks, most smaller banks, and every non-bank lender active in New Zealand. Additionally, there are many construction and development finance lenders we work with on a case-by-case basis. You won’t necessarily need to change banks either, sometimes we simply leverage our relationships to get our clients a better deal by advising them how to restructure their lending with their current bank’s loan products. Your existing bank may say ‘No’, we have the knowledge and options in our ‘toolkit’ to get that changed to ‘Yes’!

Banks tend to be more cautious as its not within their credit policy (think of this document like their ‘what we can and can’t do’ guide). They may offer you a lower loan amount, shorter loan term or higher repayments to satisfy their comfort level around your situation and ability to repay the lending. Sometimes you may inadvertently limit your options by answering their questions – saying something casually like “I’m going to retire at 55” for example, will mean they limit your loan term to less than 30 years if you’re 40 or older.

Why do we work with so many different lenders to get you the best deal?

- Your existing bank knows you…this is seldom an advantage. We’ve seen clients on very high incomes, who missed one phone payment, and were then declined for a home loan by their own bank.

- The differences between lenders are more than their advertised interest rates and are hidden deep within their credit policy.

- We’ve experienced a bank stop lending money halfway through a renovation.

- Banks and non-banks don’t specialise in construction or development lending.

- Treatment of property investors differs greatly between lenders.

- Debt consolidation lending can get you ahead much quicker if we explore all available options to you.

- Self-employed borrowers will be treated poorly at a bank unless they have at least two years of financial statements or earn a salary from their business of (generally) above $300,000 per annum.

4. Access to the Best Interest Rates and Pricing.

As many lenders have very similar rates we always try and educate our clients that the interest rate isn’t the most important factor. Rather it is the service and advice you receive from us to coach you to your goal – whichever bank or lender we select. In the current rising interest rate and cost environment, we are exceptionally well placed to assist in finding a solution that is in your best interests for the long-term. We process mortgages every day, so we know exactly what all the lenders are currently offering. They email us a lot! If you work with the bank directly, their mobile mortgage manager, or an aligned Broker you only have a few choices. You don’t know what to ask for or what is currently on offer ‘across the road’. We will negotiate on your behalf, saving you the time and legwork, as we are dealing with numerous lenders and know what they have offered recently for a similar client. Very often the outcome achieved is better than the advertised rates or rates that they first offer.

Any bank loan fees we know can be waived will be requested, as well as any cash-backs and other first home buyer extras. Most importantly we will show you the fastest rate possible to pay off your mortgage and be debt free sooner, all avoiding bank charges and penalties already touched on. That will save you hundreds of thousands of dollars over the life of your loan.

All this is achievable by our team because we build a relationship with the in-house ‘Broker Unit’ at each bank, and they see the repeat business we bring to them. We can lean on our Business Development Manager (BDM) at the lender too if we think their service or offer could be improved. We present all the facts and information upfront (remember all those forms and questions when we got to know you) – this pays dividends now. Your financial world will be modelled out with the new lending included customised to your unique situation. This way the lender knows that we bring excellent clients to them who have received good advice explained simply and who will be able to repay the loan comfortably.

5. It’s a Service FREE to You – We are Paid for our Services by the Lender (most of the time).

When you buy a home or refinance your mortgage with a bank, we are paid a commission by the bank or lender you have chosen to take out your loan with after your home settles*. Because the adviser’s fee is paid by the bank or lender, their service usually comes at no charge to you. If there is a fee for service involved, we will let you know during the beginning of our professional relationship and only proceed with your agreement and understanding. Typically, this occurs for some non-bank lending or development finance, and can be added to the loan so you don’t have to find the money yourself. This has never been an issue for our clients as the alternative was a ‘No’ with the bank.

*Settlement day is when the property you have bought becomes yours. Your Solicitor will update the title in your name/s and register the mortgage in the name of the lender on the title. They will also advance funds from your deposit and the loan from the bank, or lender, to the seller (Vendor).

What are the Downsides of using a Mortgage Broker?

There are potential downsides to using a Mortgage Broker for your home loan. When you are ‘shopping’ for a Broker, be sure to tell them what you are trying to achieve now and for the medium and long-term. Don’t be afraid to ask them their level of experience with clients in a situation like yours and whether they are aligned or independent.

Consider the following points:

- Lenders pay brokers a commission, so they might be biased toward particular lenders. Make sure you engage with a Broker/Adviser accredited to work with multiple lenders to ensure their advice is independent. We also undertake CPD (continued professional development) and have our advice process audited regularly against best practice to minimise potential conflict of interests.

- Brokers don’t cover all lenders, there are some banks who don’t work with mortgage brokers. The largest example is KiwiBank, they only work with a handful of Brokers due to capacity restrictions within their team. Their CEO knows the value of Brokers and predicts that 85% of their loans could originate from them in the future. Watch this space.

- Brokers are not all the same (see #2 above). Make sure you find someone experienced in the services you require whether that is first home lending, property investment, property trading or flipping, development finance, or debt consolidation and wealth creation.

- Sometimes you will get a quicker outcome if you go to the bank directly. But you have to know what to say (and not say), what to bring along to the appointment and what clients in a similar position to yours are eligible for. Remember, you won’t receive any advice either.

Using our Financial Modelling software and the mortgage repayment calculator on our website, we show you how to get you to your financial goals sooner. Our team prepare all the documents for your new home loan with your Solicitor in time for settlement and move-in day!

Everyone’s situation is unique, and we provide you with an individual plan in keeping with our ‘clients for life’ philosophy.

Book a time to meet today if you’re thinking about buying.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.