Buying your First Home in New Zealand

How to make sense of the current property market and available incentives to help you into a home sooner plus 7 quick tips for first home buyers.

Recently there has been a shift in the New Zealand housing market. Buyers have more things in their favour, with an increase to house price caps for Kainga Ora’s First Home Grant and banks opening their loan books to buyers with less than 20% deposit. As there are more buyers than sellers currently it is known as a ‘buyers market. There are many new-build developments complete and waiting for buyers and olders homes are taking longer to sell. There is a lot happening, that’s why we’ve put together this article to help you make sense.

Our free first home buying guide ‘First Home Masterplan‘ is available to download as an e-book too.

7 Quick Tips for First Home Buyers.

Buying your first home may seem daunting. Always keep in mind that thousands of New Zealander’s have achieved this goal before you. Even if the banks says no or you think you will be years away from buying a home, we can help. Here are 7 quick tips for first home buyers and the links to check your eligibility. We have further explained some of these within this article:

- You can buy a first home if your deposit is less than 20% of the home’s value.

- Most banks require part of your deposit to come from savings such as KiwiSaver or cash.

- You can top-up your deposit with cash gifts from friends or family.

- If you are a KiwiSaver member you can use your savings for your deposit.

- You can buy a first home if you have a student loan, vehicle finance or hire purchases.

- If you are eligible for the Kāinga Ora First Home Grant, you could receive up to $10,000 for your deposit.

- You can buy a first home with your friends or family.

Mortgage Lending Rules Softened by the Reserve Bank in June.

The Reserve Bank (RBNZ) has altered the mortgage lending rules that the main banks in New Zealand must follow. They have indicated that on June 1, 2023, the banks will be able to lend to more borrowers with less than 20% deposit. The RBNZ have lifted the cap, from 10 per cent to 15 per cent, of new mortgage lending for the banks. Economic and real estate commentators have mentioned that this will likely increase first home buying activity throughout New Zealand. If the banks have more money to lend out, they will be aggressive in promoting this – they need to lend money to make a profit. We think this will lead to increased options for first home buyers.

Let’s Talk Deposit – How Much do we Need to Buy our First Home?

A deposit is the total amount of money are putting towards the house purchase. The remainder of the money will come from the bank. You don’t have to keep saving until you have a 20% deposit. Banks are able to lend you the money for a home loan with a 10% deposit. It may be scary for you to think about, but you can buy a home for $1 million dollars if you have $100,000 deposit for example.

There are initiatives available through Kāinga Ora to buy with a deposit of 5%, which means you could buy a $1 million dollar home with a $50,000 deposit. This is called a First Home Loan. Have a read of our guide on the First Home Loan then get in touch if you think you might qualify. We will assist you to ensure you meet Kāinga Ora and the participating bank’s lending criteria.

Our team complete the assessment to determine what size home loan you can afford. If you have $100,000 as a deposit as per the above example, we then ensure you can pass the bank servicing criteria for a $900,000 mortgage.

There are a few more hurdles to jump through if you buy with less than 20% deposit, but we are experienced in answering all the banks’ questions and will guide you through this.

Later on in the home buying journey we will talk about the 2 types of deposit when buying a home because you don’t need to pay your total available deposit to the Real Estate Agent when you’re ready to make an offer.

What Can We Use as a Deposit?

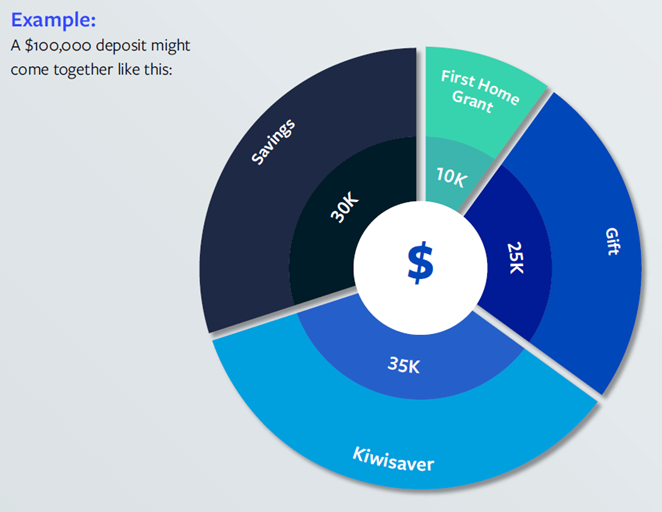

Your deposit can be made up of money from various sources. 4 of the most common options are shown below. These could include savings; KiwiSaver, First Home Grants or a cash gift or loan from friends or family. Non-bank lenders will also let you borrow money if you are short for your deposit.

Talk to our team if you need advice on what you can use as a deposit and how to pull it all together.

Kāinga Ora’s First Home Grant Programme

Kainga Ora’s First Home Grant helps eligible first home buyers with their deposit, by offering a government contribution of up to $10,000 per person (or $20,000 for a couple buying together). How much assistance for your deposit is determined by how long you’ve been in KiwiSaver and whether you buy a new or existing home. Did we mention you don’t have to pay this back!

Eligibility for the grant depends on a few different things:

- You must have contributed at least 3% of your income to a KiwiSaver scheme for at least 3 years.

- You must live in the house for at least six months.

- You must have a single income up to $95,000 or a combined yearly income of $150,000 or less (before tax) for two or more applicants.

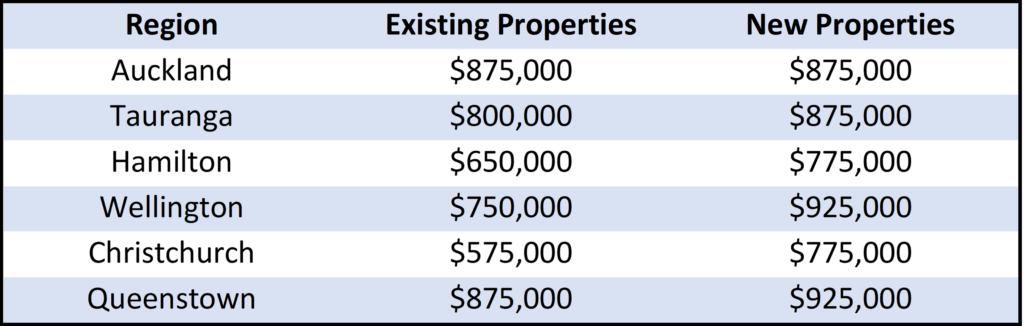

- You must buy a house within the regional house price caps (think: maximum purchase price).

See price caps within the table below:

Using KiwiSaver to Buy Your First Home.

To withdraw your KiwiSaver funds to buy, or build, your first home, you need to check you are eligible. You can withdraw your Kiwisaver contributions made by you and your employer towards your deposit. You can only do this if you’ve been contributing to KiwiSaver for more than 3 years. You must leave a minimum balance of $1,000 in your account and live in the house for at least 6 months. The easiest way to determine your eligible funds for your deposit is to contact your KiwiSaver fund provider and ask for a First Home Withdrawal letter. Forward this to us as confirmation of eligibility for the bank.

Your solicitor will make the withdrawal application once you have a valid sale and purchase agreement or pre-auction information pack for a property you intend to bid on. This can take up to 10 working days to be processed.

What if we have a Student Loan or Hire Purchases?

You can buy a first home if you have a student loan, vehicle finance or hire purchases and credit cards. What the bank is looking for is the total amount of credit you have active and your repayment history. Even buy now, pay later facilities or an overdraft are credit. There are things you can do to make yourself more attractive to banks, we will guide you through this and propose solutions to repay and close as many of these financial obligations as possible to get you approved. Not all consumer lending has to be repaid before you can buy, often we will advise you the best time to apply is in another few months or when one or two of these are repaid or reduced.

The sooner you get in touch when thinking about buying your first home the better – there is probably no situation we have not worked through before.

Will we get a ‘Cashback’ or Cash Contribution from the Bank?

Generally, banks only offer a cashback or cash contribution to borrowers with a 20% deposit or greater. This is known as low LVR (loan-to-value) lending. Banks occasionally run promotions for those with less than 20% deposit. A cashback is free money & non-taxable, you will have to stay with the bank for 3-4 years. The loan servicing criteria when buying with less than 20% deposit is more restrictive, meaning generally we can’t apply at any bank. However, we encourage you to buy when you can versus waiting to buy to receive a few thousand dollars cashback that another bank may be advertising.

There are strategies we can guide you on to become an existing customer with more than one bank, opening up options to apply to multiple banks if your deposit is less than 20%. If you are then eligible for any current promotions, we will let you know.

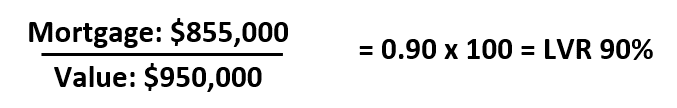

To calculate your LVR, divide your total mortgage balance by your homes’ value and times by 100.

An example with a 10% deposit:

What will our Mortgage Repayments be?

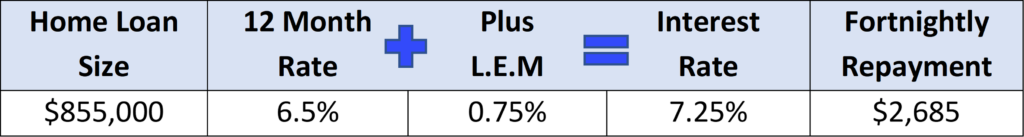

The interest rate you pay will be determined by the LVR (loan-to-value ratio) of your home loan and the loan product type such as a fixed, floating or a redraw type home loan. If your home loan is more than 80% of the property’s value, a low equity margin (LEM)* will apply. The LEM is an interest margin that customers have to pay banks to cover their risk for these loans. All banks have a variation of this.

It is only when you are unconditionally approved to buy a home that the interest rates for your loan are offered by the bank. We discuss these with you, as well as any incentives such as a cashback, and prepare the final documents outlining your home loan’s ‘structure’ to be returned to the bank and your solicitor. Using our Financial Modelling software, we will prepare a recommended loan structure specific to your personal situation and answer your questions – how much to fix or float, how long for, should we split our loan, do we need a redraw facility?

To check your repayments using our mortgage calculator Click Here. The example within the table below is based on a home loan of $855,000 for a buyer with a 10% deposit buying a $950,000 home. In this case a LEM of 0.75% will apply:

*We will check in with you as you pay off your loan and the property increases in value. Once the loan is below 80% LVR then we will apply to the bank to have the LEM reduced or removed. Usually, the banks allow this 6 to 12 months after settlement. This will provide access to lower interest rates on offer and save you money on your regular home loan repayments.

How Much Should we Budget for ‘Other’ Costs?

It’s a good idea to budget for around $5,000 of other costs. If you plan on using every last dollar of your savings for a deposit, it might pay to check in with friends or family for assistance with some other expenses you will encounter when buying your first home.

These could include:

- Solicitor’s fees. Budget $1,000 to $1,500*.

- LIM report (Land Information Memorandum). Budget $300 to $500.

- Builder’s report. Budget $500 to $1,000.

- Registered valuation report (RVR). Budget $700 to $1,200.

- Moving costs. Budget $500 to $1,500.

*Solicitor’s fees will vary depending on your location in New Zealand. There are more solicitors in the main centres and prices are lower due to competition and their use of technology. The amount of work they will be completing for the transaction, such as reviewing the LIM report as well as the agreement and property information will also determine their final cost. Your solicitor will make the application for your KiwiSaver withdrawal, First Home Grant, gifted money or guarantee and will charge you for their time accordingly. Buying your first home can be more expensive than your 2nd home or if you decide to refinance your mortgage.

Why use a Mortgage Broker to Help Buy Our First Home?

It’s a service free to you. We are paid for our services by way of commission from the bank/lender after your property settles. We work with all the main banks, and many smaller regional banks in New Zealand. As lenders have very different lending criteria, you may sell yourself short by only approaching one of them. Don’t worry, we are up to date with the regular policy updates and announcements from all the banks.

You may have been told you cannot buy your first home now by your bank and will not be given a plan of what you need to do to get into a home as soon as possible. This is because a bank can’t provide you any financial advice – only an Adviser can do this.

Quick FYI. Mortgage Broker = Mortgage Adviser.

We also work with dozens of non-bank lenders who help first home buyers. Often if you are recently self-employed or have some credit issues for example, they are a great solution.

We will show you how to be mortgage-free sooner, save (often hundreds of thousands) on loan interest and model your financial situation and goals to age 100. Every customer’s situation is different, and we provide you with an individual plan in keeping with our ‘clients for life’ philosophy.

For every new customer that we help buy their first home we donate to Trees that Count. This helps ensure all New Zealander’s can enjoy our beautiful country by planting trees and restoring habitat throughout New Zealand.

If you’re ready to talk to about getting into your first home sooner, book a chat today or phone Mike on 021-402-508.

Book a time to meet today if you’re thinking about buying your first home or even if you think you’re years away.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.