Non-Bank Lenders in New Zealand

Have you ever wondered about the role of non-bank lenders in the New Zealand lending market? Just like choices at your local cafe, there are multiple options to consider. Read on to explore the facts and common misconceptions about these vital bank alternatives.

Often overlooked in favour of traditional banks, non-bank lenders are an excellent alternative worth exploring. In this article, we’ll delve into the intricacies of non-bank lending institutions, dispelling common misconceptions and shedding light on their vital role in New Zealand’s home loan market.

A Non-Bank lender, often referred to as a ‘second tier lender,’ serves as a flexible source for borrowing funds across various financial needs, from home loans for owner-occupied or investment purposes, business investments to debt consolidation and asset financing. Over the years, these lenders have witnessed a notable surge in their market presence, primarily driven by shifting dynamics within the mainstream banking sector, which has become more receptive to unconventional lending practices. Their combined market share, which once stood at three percent, has now reached above five percent in New Zealand, and experts predict this figure will continue to rise, potentially reaching 10-15% within the next few years.

What is a Non-Bank Lender?

Simply put, a non-bank lender stands apart from traditional banks by not accepting deposits, they don’t do credit cards, term deposits or other ‘bank-type’ products. However, despite this financial distinction, non-bank lenders and banks share a common goal: to provide individuals with home loan options while upholding principles of responsible lending. Non bank lenders will secure their funds for lending most commonly through:

- Credit arrangements (finance/capital) from the main trading Banks.

- Institutional Lenders.

- The ‘Peer to Peer’ model.

- And self-funding.

They all have their preferred niche and target client – e.g., property developers, long-term mortgages, property investors, business owners, discharge from bankrupt, asset finance.

Are Non-Bank Lenders as Trustworthy as the Banks?

Yes, non-bank lenders are indeed legal, regulated, and managed by finance experts. They are trustworthy financial institutes, playing a vital role in fostering healthy competition within New Zealand’s mortgage market. By offering borrowers an alternative to traditional bank loans, they not only expand choices but also extend support to individuals who may not align with the larger banks’ risk criteria.

Understanding the Tiers in Non-Bank Lending.

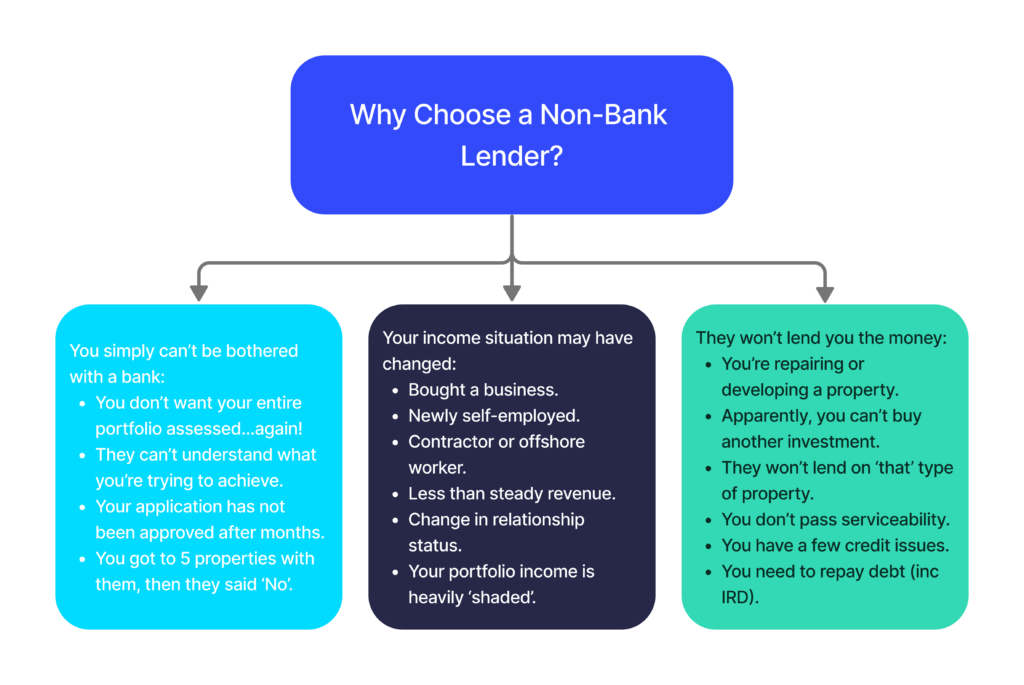

When conventional banks turn you down, whether due to reasons such as a low deposit, limited income documentation, credit history issues, or property restrictions, or if you’re simply fed up with extended processing times and delays, alternative solutions come into play.

We’ll explore these solutions, categorised into different tiers, in the following section:

- Near Prime . This is a non-Bank long-term mortgage at close to Bank rates. Some lend up to 80% (and above) of the property’s value, including for investment properties, either as a standalone deal or ‘bundled’ with an owner-occupied property. Others take a more lenient view on existing borrowing and concentrate on the ‘numbers’ for the application, and the return achievable, meaning greater borrowing capacity in many cases.

- Specialist. A medium to long-term mortgage, usually without early repayment charges to allow rapid loan repayment and designed to help those who have suffered poor credit, are recently self-employed, or who cannot verify their income in the traditional way. The plan is to get to main Bank rates as soon as possible, perhaps through paying down the loan, or once financial statements are to hand.

- Short-term. Usual loan terms are to 12 to 18 months and installed to ‘fix’ something. The loan may be for renovations, a build/re-clad, subdivision, or a property trader. Often used to get people into a property, and refinance when the issue is resolved. For example, recently discharged from bankruptcy, recent self-employment, change of industry, new to New Zealand. The options are extensive; however, the theme is the same – a short-term issue that can be resolved and then the move to regular lenders.

- Second mortgage or Caveat lending. Usually for smaller sums and a shorter term, less than 12 months. Caveat lending is usually for sums up to $100,000, and short-term. An exit strategy is essential. As for Short Term above, they are designed to ‘fix’ something and then get repaid by either when the property is sold or refinanced once the issue has been resolved.

- Asset Finance. Can be used to lend money for multiple reasons, secured by an asset such as a vehicle (car, truck, boat, motorcycle). Terms are up to 5 years, and rates are affordable due to the security available for the Lender. Typically done to consolidate debt, refinance high interest vehicle lending or provide funds to complete a project as above.

Who Are the Top 6 Non-Bank Lenders?

We possess expertise across various non-bank lending categories and maintain strong partnerships with multiple lenders. Our accreditation extends to most non-bank lenders in New Zealand, including the following companies:

- Avanti Finance.

- Bluestone.

- Basecorp.

- Liberty Finance.

- Resimac.

- Pepper Money.

There are other lenders that may fit your needs which we determine and provide options to you if required.

Is Opting for a Non-Bank Instead of a Traditional Bank the Best Choice?

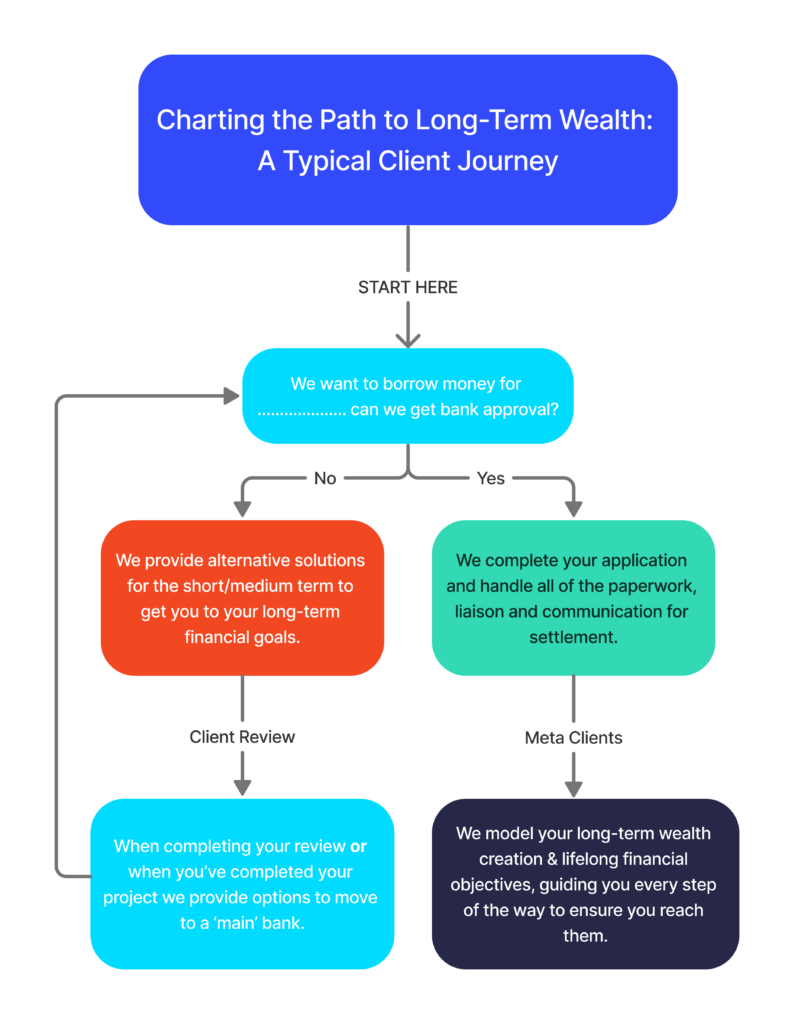

If your application qualifies for approval at a traditional bank, that’s the route we’ll suggest. We take a thorough approach, working through your unique situation and lending needs with multiple banks to gauge their interest in your deal. Leveraging our understanding of bank criteria, we make a compelling case for why they should approve your application.

If your application doesn’t meet the criteria for approval at a traditional bank, we shift our focus to alternative solutions. In such cases, we draw upon our extensive network of non-bank lenders, offering you a range of options that align with your objectives.

Why Non-Bank Lenders Are a Great Option on Your Path to Prosperity.

We are committed to expanding our clients’ awareness and utilisation of non-bank lenders. Far too often, individuals perceive a bank’s ‘No’ as an insurmountable roadblock, causing them to abandon their wealth creation aspirations prematurely. We operate under a ‘Clients for Life’ philosophy, committed to your long-term financial well-being and growth – which may include a non-bank lender.

We hope to have illuminated the path toward a more informed and empowered approach to your financial decisions. Non-bank lenders, often overshadowed by their traditional counterparts, offer a wealth of opportunities. Your journey to financial success begins by considering all the options and recognising the value of these financial institutions.

Contact us now to start your wealth creation journey.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.