Simplified Financial Planning for Achieving Financial Freedom

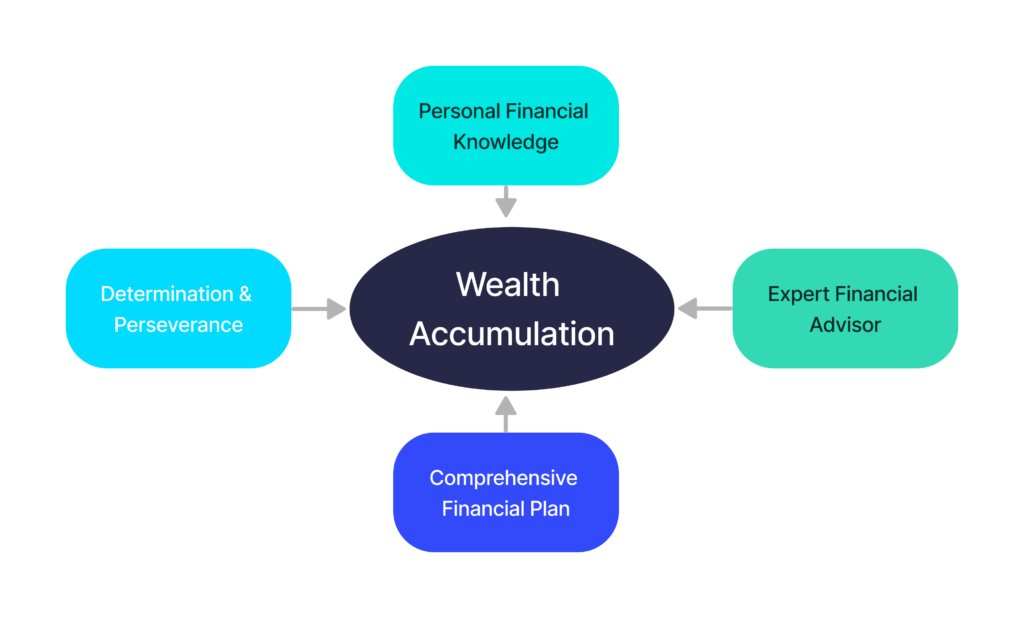

Financial Planning combines a personalised financial plan, carefully engineered by a Financial Advisor, to illustrate the path towards earlier financial freedom.

Our Financial Cashflow Modelling software maps your journey, spanning your life decisions all the way to age 100. Our plan will consider your wellbeing, ideal lifestyle, home life, family, business, work and long-term aspirations.

This will give you the confidence needed to understand your financial situation and make the best decisions for tomorrow. Read on to see how we’ll help you obtain financial freedom and peace of mind earlier.

Every New Zealander Can Have a Personalised Financial Plan.

In New Zealand, conversations about money and wealth aren’t typically on the forefront of our discussions. We often feel uneasy around those who are financially successful or openly discuss their financial matters. It’s natural to feel uncomfortable about actively improving your financial circumstances, especially when you may not know anyone else who has taken the step to create a personalised financial plan.

However, it’s crucial to recognise that securing your financial well-being and achieving the lifestyle you desire is a great idea. We are here to guide you through the process of identifying your current and future lifestyle aspirations, bridging the gap between the two. This journey is meticulously charted out for you through a comprehensive and tailored strategy, which you can conveniently track and monitor via our client portal. Your financial future is within reach, and we’re here to help you attain it.

A Financial Plan Shouldn’t Be Scary.

A financial plan, or budget, should never be something that instils fear or feels restrictive. In fact, it’s quite the opposite – a financial plan is your roadmap to living the life you truly desire. It’s a tool that sheds light on any budgeting challenges you may face, helping you understand whether you’re on track to achieve your lifelong aspirations and identifying areas where you need to focus your efforts. We meticulously model various decisions and their potential outcomes, avoiding generic ‘rule of thumbs.’ Your personalised plan is designed to provide clear answers and, more importantly, boost your confidence in the financial decisions you’ve made thus far and the path to your future financial security.

We Have a Mortgage/Insurance Broker or Investment Adviser – Why do we Need Lifetime Cashflow Modelling?

Certainly, the distinction lies in the level of advice and the value you gain. While banks may not (and cannot) provide personalised financial advice, and transactional relationships with brokers are limited in scope, engaging in lifetime cashflow modelling brings an entirely different dimension to your financial strategy. A comprehensive written financial plan instils confidence in your ability to reach your financial goals. It also fosters better saving and investing habits while ensuring you can provide for yourself and your loved ones in unforeseen circumstances. These services are at the core of what we offer because we believe that this level of advice can truly be life-changing.

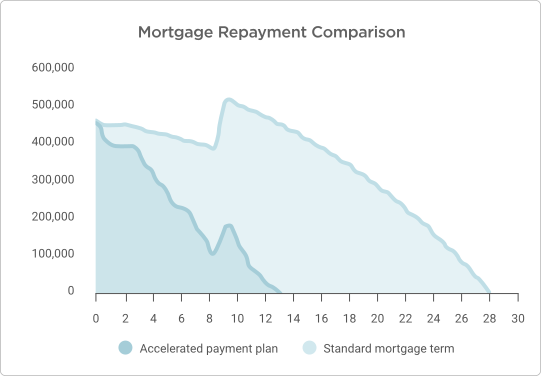

Often we delve into financial planning strategies after we have completed one piece of work for clients, with a prime example being our approach to clients seeking home loans. Our team provides an Accelerated Repayment Plan, designed to empower clients with effective loan repayment strategies, ultimately resulting in substantial savings on loan interest. The immediate positive impact on their net worth becomes evident, often prompting clients to exclaim, ‘Wow! The bank never showed us this before.’

Consequently, many clients begin to scrutinise their past financial decisions, leading to discussions with our team where they frequently raise one or more of the 11 common concerns outlined below:

-

We weren’t shown how to repay our mortgage faster?

-

Can we afford to work from Bali for 12-months?

-

We earn a really good income, but we never seem to have enough for living life?

-

We’ve heard you can save hundreds of thousands of dollars in interest on a 30-year mortgage without changing your lifestyle?

-

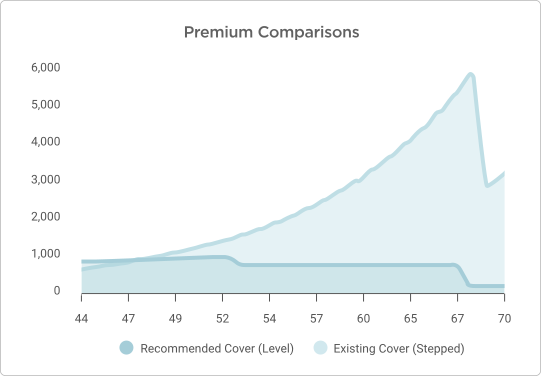

Our insurances keep getting more expensive every year? Do we need all this cover?

-

Can we use the equity in our home to buy an investment property?

-

We have two investments properties – isn’t that enough to retire on?

-

How long will our money last when we choose to retire?

-

Is now a good time to invest? We’ll start when we can afford too.

-

Unfortunately, a family member passed and (gratefully) left us an inheritance – what should we do with the money?

-

Should we increase our home loan repayments or KiwiSaver contributions?

Don’t Put off Planning for Tomorrow.

Planning for your future may seem like a task to postpone for another day. While it’s true that financial planning can be challenging, especially when done alone, it offers undeniable benefits. It serves as the solid foundation upon which you can build, understand, and ultimately achieve your goals, regardless of your current financial situation. So, don’t delay this crucial step to tomorrow.

Navigating the intricacies of money management, retirement savings, investments, and insurance can indeed be daunting, but the good news is that you don’t have to do it alone. Our dedicated team at Meta Financial Solutions is here to simplify and streamline the entire process. We operate under a ‘Clients for Life’ philosophy, committed to your long-term financial well-being and growth. Unlike one-off transactional advice, we provide comprehensive support throughout your financial journey.

Are you ready to take control of your future and explore options tailored to your needs?

Your financial peace of mind starts here.

Contact us now to start your journey towards a more secure and stress-free future.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.