The Return of Interest Deductibility for Landlords in New Zealand

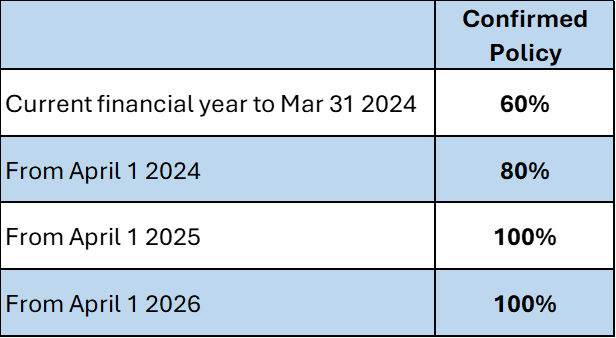

Associate Finance Minister David Seymour has announced the Coalition Government’s final plans they have been working since the election. He said in a statement this week (March 10th 2024). Landlords can claim 80% of their interest expenses from April 1, 2024. They can claim 100 percent from April 1, 2025, onwards.

In this article, we explain the recent changes in New Zealand’s tax policy regarding interest deductibility for landlords and property investors.

Interest deductibility for residential property investment refers to the ability of property investors to deduct the interest they pay on their mortgage from the tax on the property. Property investors pay tax based on their taxable profit. The higher your taxable profit, the more tax you pay. Your profit depends on your income minus your expenses.

Mortgage interest costs are an expense. Labour introduced the rules during their term. Under them, interest no longer counted as taxable profit. Investors could not count their borrowing cost as an expense. They could not include interest in their financial statements and tax returns. This was not in line with tax policy in New Zealand, where a business can fund growth through debt. The business can then claim the interest cost on that loan as an expense.

Why were landlords allowed to deduct their interest and reduce their taxable profit?

A business can deduct interest used to borrow money. They subtract interest expenses from the business’s taxable income. The expenses come from loans or credit used to acquire inventory, plant or assets. This deduction reduces the business’s taxable income. It lowers its tax and raises its after-tax profits. If you are a property investor, you are a business owner. Your business is providing accommodation for tenants (your customers).

The business (the landlord) deducts the interest payments on these loans from their taxable income. Interest or borrowing costs are an expense in the spreadsheet. This reduces its tax burden. It frees up capital to reinvest in the business. This allows the company to finance expansion. It can invest in new equipment or technology, hire more employees, or (in the case of the landlord) upgrade, repair or maintain the property.

The previous Labour government removed the ability for landlords to deduct their interest expense. This was not in line with taxation policy in New Zealand and around the developed world. The IRD recommended against this policy change.

Why is this important?

Private landlords, by far, account for the most rental properties in New Zealand. They own around 85% of the 530,000 properties. Making it harder and more costly to buy rental properties will cause fewer to enter the market. This restricts supply and contributes to the housing shortage in New Zealand.

The IRD were against the rules when introduced at the time. They said it increased compliance costs for landlords, and it went against tax policy. There needs to be more ways to increase housing supply in New Zealand, not more restrictions. Therefore we feel the reintroduction of full interest deductibility is a good thing.

Kelvin Davidson, CoreLogic’s Chief Economist, said rental costs are unlikely to fall. Rents will likely rise more slowly. Landlords and investors don’t need to raise rents a lot to off-set their losses. Rising income and expenses that are sustainable help a business. They contribute to long-term stability and growth.

What are the new lower taxes for property investors confirmed?

Instead of claiming only 50% of your interest costs in the 2024/25 financial year, you’ll soon be able to claim 80% of your interest expenses from April 1 2024 and 100 percent from April 1 2025 onwards. Landlords won’t be able to claim the expenses retrospectively as initially indicated. The media noticed that landlords will pay lower taxes. This is due to the treatment of loan interest outlined within this article.

The lower taxes, compared to the previous Labour Government, arises from the lower on-paper profit a property will make in a financial year. A lower profit will equal less tax. This realigns borrowing for property investment taxation rules with taxation policy in New Zealand. Businesses (landlords) will likely feel incentivised to invest in property again and provide accommodation for tenants.

Find out if this will affect you through partnering with the right team!

In summary, it’s crucial for property investors to understand the nuances of the reinstated interest deductibility rules in New Zealand. To navigate these complexities, you need a knowledgeable team. It should include a Financial Adviser, lawyer, and accountant. Getting professional advice is key to making an informed decision. It maximises your success in property investment and ensures you are on-track to building your wealth and lifestyle goals.

At Meta Financial Solutions, we are dedicated to guiding clients through their property investment journey. Your success remains our top priority.

Further reading:

Let’s navigate your Wealth Creation journey together.

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.