Debt to Income Ratios – How they Might Affect You in New Zealand.

Our Debt-to-Income (DTI) ratios guide explains what they are, and whether they will influence your prospects of getting a mortgage. The changes affect how lenders assess new lending applications. But not all.

The Reserve Bank (RBNZ) is overhauling the criteria for mortgage lending in New Zealand. It plans to put in place debt-to-income ratios (DTI) by the middle of 2024. The goal is to cut risks to financial stability, and support sustainable house price growth. Most banks have already rolled out the changes to Mortgage Brokers.

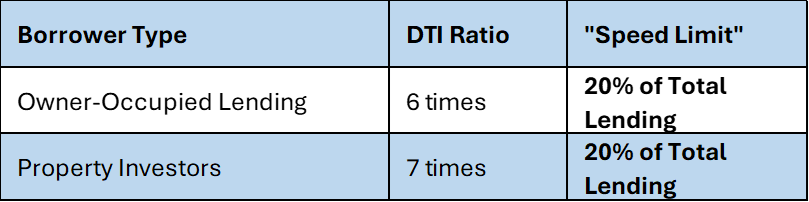

DTI ratios measure the amount of debt compared to income. They show a person’s financial stability, and their ability to make mortgage payments. A DTI will limit how much you can borrow as this will be tied to your income. They are important measures of financial stability and risk. They matter to both people and mortgage lenders. They will become crucial to consider when applying for a mortgage from mid-2024. The RBNZ is implementing DTI restrictions on the volume of bank lending to consumers. These are known as ‘speed limits’. These will limit the amount of borrowing to home-owners and investors where the DTI is ‘too high’. This is shown in the below table:

What is a Debt-to-Income Ratio?

DTI ratios are expressed as multiples. Higher multiples mean more debt relative to the borrower’s income. A DTI is best explained through an example:

- $650,000 mortgage = $650,000 Total Debt.

- Borrower’s annual income $85,000 (gross) + partner’s income $70,000 = $155,000 Total Income.

- DTI ratio = $650,000 / $155,000 = 4.19 x

In this example your DTI ratio is 4.19, meaning your total debt is 4.19 times your yearly income.

How Will DTIs Impact Me?

DTI ratios are important for individuals and mortgage lenders. A high DTI can show that you have too much debt compared to your income. This makes it hard to pay all your debts, including your mortgage. High debt can put you at risk of default on your mortgage. You might then lose your home in a mortgagee sale. The new rules will apply if you are buying an existing property or topping up your mortgage.

Lenders use DTI ratios to assess the risk of lending to an individual or household. DTI ratios will become another factor in their approval process. They may be less likely to approve a mortgage if the DTI ratio is too high. Also, a high DTI ratio may mean that a person or household is already stretched thin financially. They may struggle to make regular mortgage payments.

DTI measure financial risk for people and mortgage lenders. Understanding your DTI ratio and improving it can raise your chances of getting a mortgage. It can also make it easier to manage your debts. A high DTI ratio does not prevent banks or lenders from approving you for a loan. The lender considers the borrower’s full financial situation. Factors such as a high income, a strong credit score, or many assets can offset a high DTI ratio.

Financial Advisers are experts at getting applications approved that would otherwise be turned down by a bank . We know the mitigants / factors to discuss to reduce the risk in an application. We also know how to discuss the loan application’s exit strategy. This helps the lender know how they will get their money back.

How are Debt-to-Income Ratios Calculated?

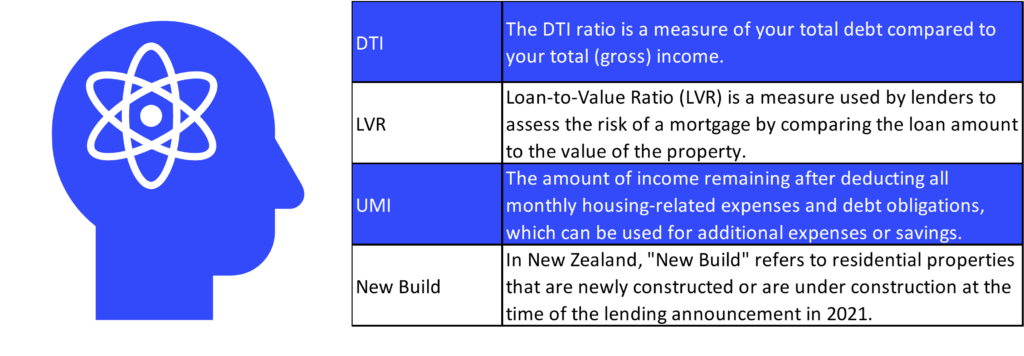

The DTI calculation will consider all applicable income types for the borrowers. We will also consider all debt the borrower has, whether they are paying interest on this debt or not (i.e. student loan or buy-now-pay-later facilities). As the above example shows the DTI calculation can be straight forward. Factoring in multiple income sources and debts can lead to complexity. The RBNZ has imposed different DTIs for different lending applications. We will consider the LVR and UMI in your application as well. We will also consider if the bank holds one or more properties as security, and if the application is for owner-occupied and / or investment properties. Here are some more complex examples:

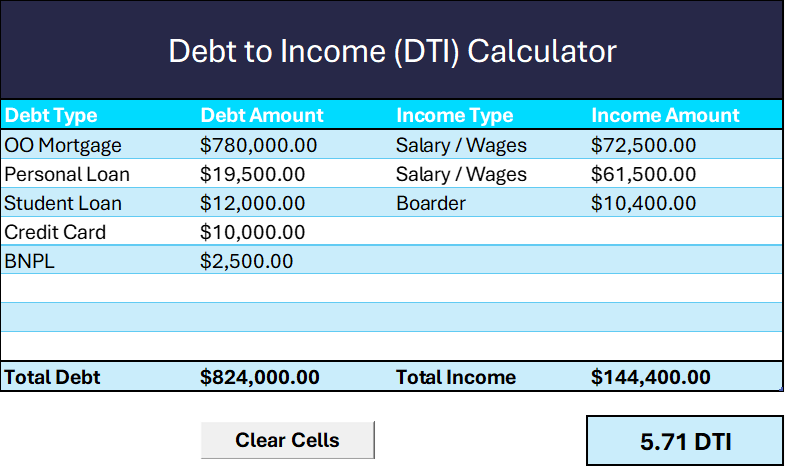

First home buyers with a student loan, personal loan, credit card limit of $10,000 and buy-now pay later (BNPL) have a DTI of 5.71x.

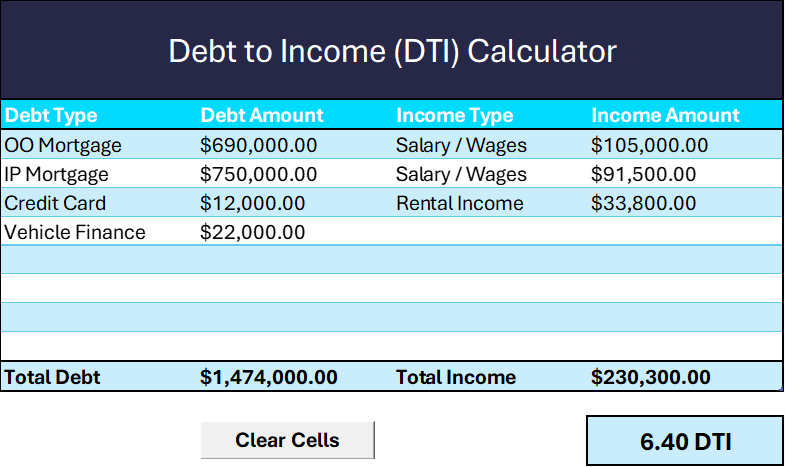

Investors with a personal mortgage, rental income of $650 p.w, credit card & vehicle finance have a DTI of 6.40x.

I’m a First-Home Buyer, Now it will be Even Harder Right?

DTI ratios will apply to first-home buyers. So, it’s important to know your DTI ratio and improve it. We recommend as many years as you can before you think you are ready to buy a first home. This will increase your chances of getting a mortgage. It will also make it easier to manage your debts as interest rates change.

How Much do I Need to Worry About DTIs as an Investor?

Property Investors with large mortgages will be most affected by the introduction of DTIs. They could be investors or owner-occupied borrowers. Before, an investor may have been able to afford a new purchase. But, the limit now is not their deposit or equity, but their DTI. The “speed limits” aim to reduce bank lending at a high DTI, not prohibit it. The RBNZs research indicates that less than 20 percent of investor lending is currently above a DTI of 7. They feel it will only impact investors when the market re-enters a ‘boom’ phase. Lenders can still approve borrowers with a high DTI. These borrowers will have to take steps to improve their DTI. Other favourable factors will be considered. Using many properties as security also helps. So does having fewer debt facilities overall.

Will There be any Exemptions?

The Reserve Bank has announced that the main exemptions will be for newly constructed dwellings ‘New builds’ and Kāinga Ora loans. The intention being, they do not intend to restrict the supply of new housing, or Kāinga Ora loans for low-income households. Buying a New Build will be exempt whether this is a home to live in or you intend to rent this out. DTI restrictions will also not apply to loans for commercial property or lending for business purposes.

Will House Prices Still Go Up When DTIs Come In?

Yes. The Reserve Bank states this themselves[1]. House prices will still increase when DTIs are introduced, as has happened overseas. International evidence suggests however that DTIs are a more effective measure for moderating house price increases than LVR restrictions. They believe this is due to DTIs being linked to income growth, which results in stable house price increases and more financial stability to minimise the risks associated with the ‘boom and bust’ of the credit cycle and property market. Personally we prefer a strong property market, with steady increases per year, as opposed to the boom and bust of house prices and the construction industry in New Zealand.

Navigating Lending Rules with Confidence to Secure Your Long-Term Financial Success.

In summary, whether you own a home, are planning your first-home, or invest in property, you need to understand how DTI ratios will impact your wealth creation goals. You should know your DTI ratio and keep a healthy one. It will boost your financial well-being and improve your borrowing opportunities.

Navigating the ever-changing lending rules is hard. It shows the importance of seeking professional advice. At Meta Financial Solutions, we guide clients on their journey to financial success. This remains our top priority. We understand that every borrower’s situation is unique. That’s why we create personalised plans that match your goals and lifestyle.

Further reading:

How to Buy a House with a 5% Deposit – First Home Loan.

Buying Your First Home in New Zealand.

The Return of Interest Deductibility for Landlords in New Zealand.

[1] https://www.rbnz.govt.nz/-/media/project/sites/rbnz/files/consultations/banks/dti-and-lvr-settings/enhancing-the-efficiency-of-macroprudential-policy-consultation-paper.pdf

Let’s build your wealth together. Today!

Mortgages and

First Homes

Protect Your

Wealth

Create Your

Wealth

Subscribe to Our Newsletter

Get our latest blog and up to date news on a monthly basis.